South Korea’s Defense Ministry unveiled its next five-year budgetary blueprint on January 11, which indicates an average annual hike of 7.5 percent. The blueprint covers the fiscal period between 2019 and 2023. Across these five years South Korea intends to invest KRW270.7 trillion ($241.9 billion), or roughly KRW54.14 ($48.38 billion) per annum.

(LEAD) S. Korea to increase spending to build 'independent' defense capabilities https://t.co/2kfhXKshh7

— Yonhap News Agency (@YonhapNews) January 11, 2019

The national defense budget will grow from KRW46.7 trillion this year to KRW50.3 trillion in 2020, KRW54.1 trillion in 2021, KRW57.8 trillion in 2022, and finally KRW61.8 trillion in 2023. Within these budgets the Defense Ministry plans to earmark an annual average of 10.8 percent for defense capability enhancement purposes.

The most prioritized capability enhancement objective is South Korea’s three-axis, or “three pillars,” scheme for defense against threats from neighboring rival North Korea which has been titled “system to respond to nuclear and other weapons of mass destruction” by the Defense Ministry.

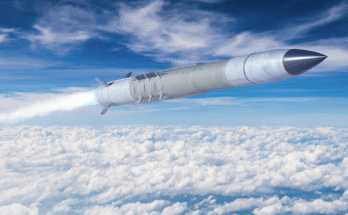

This three-tier system begins with the so-called Kill Chain concept, aimed at detecting and intercepting incoming missiles in a short timeframe. Crucial to the Kill Chain concept are surveillance assets, including military reconnaissance satellites and forward-operating Special Forces trained to take out North Korea’s central command. The firepower capabilities involved in the Kill Chain include a mixture of F‑15K tactical strike aircraft equipped with AGM-84E SLAM-ER missiles and GPS-guided Taurus KEPD 350K air‑to-ground missiles, and the Hyunmoo family of cruise and ballistic missiles.

The second element involves the Korea Air and Missile Defense (KAMD) system, intended to intercept low-flying, short- and medium-range missiles from North Korea. This element includes Patriot Advanced Capability-3 (PAC 3) missiles, medium-range surface-to-air missiles (M-SAMs, also referred to as Cheongung, or Iron Hawk), and long‑range SAM (L-SAM) systems, as well as early-warning radars.

Finally, there is the third element, the Korea Massive Punishment and Retaliation (KMPR) pillar involving an attack against North Korea’s leadership if a nuclear weapon strike by Pyongyang is detected. For such a purpose, the locally developed Hyunmoo 2A, 2B and 3 surface-to-surface ballistic missiles featuring ranges of 300, 500 and 1,000 kilometers would target the North Korean capital of Pyongyang in an effort to take out the ruling regime.

With increased funds earmarked for nuclear and missile response, the Defense Ministry intends to double the South Korea’s counter-fire capabilities by deploying advanced artillery-locating radars and 230mm multiple launch rocket systems, as well as bringing online three new AEGIS-equipped KDX Batch 3 Sejong the Great class destroyers and F-35A stealth combat aircraft. There will also be an additional KRW21.9 trillion ($19.57 billion) earmarked for research and development of other high-tech weapons and military technologies.

The latest spike in defense spending comes on the heels of a decade’s worth of military investment growth which averaged 4.5 percent over a decade. The previous five-year defense spending plan presented by the Ministry of Economy and Finance, which covered the years 2018 to 2022, called for defense expenditures to increase by about 6.6 percent per year.

Dan Darling is Forecast International’s director of military and defense markets. In this role, Dan oversees a team of analysts tasked with covering everything from budgeting to weapons systems to defense electronics and military aerospace. Additionally, for over 17 years Dan has, at various times, authored the International Military Markets reports for Europe, Eurasia, the Middle East and the Asia-Pacific region.

Dan's work has been cited in Defense News, Real Clear Defense, Asian Military Review, Al Jazeera, and Financial Express, among others, and he has also contributed commentary to The Diplomat, The National Interest and World Politics Review. He has been quoted in Arabian Business, the Financial Times, Flight International, The New York Times, Bloomberg and National Defense Magazine.

In addition, Dan has made guest appearances on the online radio show Midrats and on The Media Line, as well as The Red Line Podcast, plus media appearances on France 24 and World Is One News (WION).