By Derek Bisaccio and Jon Hemler

Infographics by Jorge Morejon

Production of Poland’s FA-50PL fighters by Korea Aerospace Industries is ongoing. Image – Lockheed Martin

On the wave of increased global defense spending promulgated by Russia’s 2022 assault on Ukraine, Europe and NATO partners stand on the crest. Nowhere is this clearer than with Polish defense spending, which has grown at a dizzying pace in reaction to the war. While Warsaw is using the funding to address all service domains, airpower is a particular area of focus for the Ministry of National Defense (MoND).

Polish defense spending in the FY21 budget, on the eve of Russia’s invasion of Ukraine, stood at around PLN58.1 billion. Especially given its proximity to the war, Poland reacted to the unfolding conflict quickly. Draft budget documentation for the upcoming year in 2025 allots PLN123.6 billion ($30.9 billion) to the MoND – and more still if the supplementary Armed Forces Support Fund is included – which is more than double the pre-invasion total.

Beneath that topline figure, the MoND has ramped up its capital expenditure, devoting PLN110 billion towards equipment acquisition from 2022 to the present, with another PLN51.5 billion to follow next year. The additional funding is enabling a generational investment in airpower, in particular Poland’s combat aircraft fleets. In the past year alone, Poland committed over $22 billion towards military aircraft and associated weapons deals, including the largest-ever purchase agreement for Apache attack helicopters. Besides new procurement, the MoND is also addressing its existing systems, advancing an upgrade project for its fleet of F-16s.

Fixed-Wing

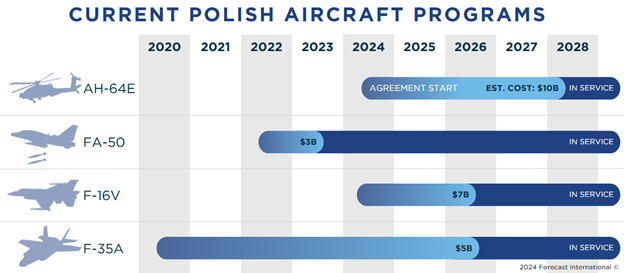

Among its many procurement programs, Poland’s acquisition of the Lockheed Martin-built F-35A is the most significant, as it will introduce a fifth-generation fighter jet capability into the Air Force. In 2020, Poland became a customer for the fighter jet, to be designated “Husarz,” ordering 32 at a cost of $4.6 billion. This past August, Lockheed Martin and Polish officials celebrated the rollout of the first completed F-35A, AZ-01, which will be formally handed over to the Air Force before the end of the year. AZ-01 and other initial samples will remain in the U.S. for the time being, performing pilot training, and will begin defending Polish skies in 2026.

As Poland awaits its F-35s, investments in its current fleet of 48 F-16C/D fighters are underway. Last month, the U.S. State Department approved a potential Foreign Military Sale (FMS) for Poland to contract Lockheed Martin for F-16 Viper Midlife Upgrade work.

The Midlife Upgrade program brings older F-16s up to the Viper configuration, which features Northrop Grumman’s SABR (Scalable Agile Beam Radar) APG-83 active electronically scanned array system, affording fifth-generation capabilities to a fourth-generation aircraft. The package also includes upgrades to the electronic warfare and targeting systems, mission computers, and avionics. No timeframe for the modernization effort is specified, but the F-16V and F-35A introduction will likely coincide.

Poland is also acquiring light attack fighters, as well, in the form of FA-50s produced by South Korean manufacturer KAI. The MoND inked a multi-stage deal for the jets in 2022, taking an initial delivery of 12 examples last year for use as trainers. Another 36 Block 20 fighters, built to a custom Polish standard (FA-50PL), will start joining the air fleet next year, to round out a total fleet of 48. Just days ago, Lockheed Martin announced that it was selected to integrate Sniper Advanced Targeting Pods (ATPs) with Poland’s FA-50s, a system the aircraft will share with Polish F-16s.

Further fighter jet purchases could be in the offing, even of another platform entirely – Boeing’s increasingly popular F-15EX. The company has been in talks with Poland over the possibility of a deal for the multirole strike fighter for over a year. Those discussions have included potential offset opportunities related to a Pratt and Whitney propulsion option for the twin-engine fighter, thus supporting Polish industry. A final decision on the fighter jet is likely in the coming year.

Boeing has offered to sell Poland F-15EX Eagle II and CH-47F Chinook (pictured) aircraft. Image – Boeing

Rotary-Wing

Besides overhauling its fixed-wing combat fleet, Poland is also taking a look at its rotary-wing aircraft. The “Kruk” helicopter program represents Poland’s most ambitious aircraft modernization enterprise. In August, Polish defense officials signed an agreement to procure 96 AH-64E Apache attack helicopters for an estimated contract amount of $10 billion. The deal is a historic export order for Boeing’s vertical lift division and will make the Polish Land forces the largest Apache fleet on foreign soil.

Shouldered with the sale, Poland will bolster its local defense industry through two related offset agreements with Boeing and General Electric cumulatively worth over $238 million.

A month later, Boeing announced it offered to sell Poland its newest heavy-lift Chinook helicopter model, the CH-47F Block II. The potential Chinook addition would not only multiply Poland’s tactical rotary-wing capabilities but strengthen the nation’s partnership with American aerospace manufacturing and NATO’s strategic air capabilities.

Weapons

To outfit its updated fleet, Poland seeks to purchase an associated arsenal of American weapons through various opportunities. As part of the broader Apache sale approved by the U.S. last year, Poland will receive more than 1,800 AGM-114R2 Hellfire and training missiles for the attack helicopters.

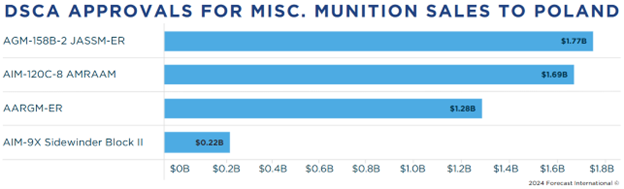

Warsaw’s interest in air-based weapons showed no signs of slowing in 2024. From March to April, Poland received approval for over 2,100 air-launched munitions – a mix of AIM-9X short-range air-to-air missiles, longer-range AIM-120C-8s, AGM-158 JASSM-ERs, and AGM-88Gs – which together carry a combined price tag of almost $5 billion.

Future of the Polish Air Force

Future of the Polish Air Force

Alongside the new procurement, Poland has also begun to offload legacy aircraft. In April 2023, Polish officials announced that the country had begun transferring some of its aging MiG-29 combat jets to Ukraine. Around a dozen MiG-29s remain in Polish service but are slated for decommissioning as the F-35s enter service. Similarly, the Polish Army delivered some of its Mi-24 attack helicopters to Ukraine, ahead of receiving the Apaches. The Air Force’s Su-22s, meanwhile, will exit the stage either this year or next.

Thus the air combat capability of the Polish Armed Forces by the end of the 2020s will look completely different from how the military entered this decade. Given Poland’s geographic location – bordering both Belarus and Russia’s Kaliningrad exclave – airspace security is no idle concern for the Polish military. Both Russian and Ukrainian missiles have crashed over the border into Polish territory since 2022, underscoring the continual risk of spillover from the conflict. Warsaw is moreover seeking the green light from its allies to shoot down Russian missiles over Ukraine, a step that if taken would certainly escalate tension with Moscow.

As a member of NATO, Poland can depend on its allies to help it navigate tensions with Moscow; however, Polish history demonstrates the necessity of pursuing as much military self-sufficiency as possible. A robust, modern air contingent will be pivotal in deterring future threats.

A former naval officer and helicopter pilot, Jon covers a range of Forecast International reports and products, drawing on his 10-year background in military aviation, operations, and education. His previous military assignments include multiple overseas deployments supporting operations in the Arabian Gulf, NATO exercises, and humanitarian missions. Jon’s work is also influenced by his time as a former Presidential Management Fellow and international trade specialist at the Department of Commerce.

Before joining Forecast International, Jon also served as an NROTC instructor and Adjunct Assistant Professor at the University of Texas, where he taught undergraduate courses on naval history, navigation, defense organization, and naval operations and warfare. A lifelong reader and learner, his academic and professional interests include aviation, political and military history, national defense and security, and foreign area studies.

-

Jon Hemler

-

Jon Hemler

-

Jon Hemler

-

Jon Hemler

-

Jon Hemler

-

Jon Hemler

-

Jon Hemler

-

Jon Hemler

-

Jon Hemler

Military markets analyst, covering Eurasia, Middle East, and Africa.

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio

-

Derek Bisaccio