In a break from tradition, Congress passed a full-year continuing resolution (CR) to fund the Department of Defense for Fiscal Year 2025, a move that provides new-start authority but hinders long-term planning. While the legislation delivers $892.5 billion for national security, including modest gains for procurement, it imposes significant cuts to research and development and operations accounts, resulting in a constrained fiscal environment even as the administration talks of higher spending levels.

Many of the topline changes cited throughout this article were sourced using Forecast International’s FY25 U.S. Defense Budget Spotlight dashboard, which visualizes how congressional defense committees reshape funding accounts throughout the budget cycle.

The topline figure in the CR represents a $6 billion increase over FY24 enacted levels, but the Pentagon ultimately loses buying power compared to last year when adjusted for inflation. The final budget is also $3 billion less than requested by then-President Biden, despite bipartisan calls for higher spending, particularly in the Senate.

Unlike a traditional CR, the legislation allows the Pentagon to launch new programs and increases transfer authority, giving program managers more flexibility with the money provided by Congress. Lawmakers also recommended consolidating portions of the acquisition budget to reduce the number of line items.

Congressional Intent Versus Execution

One complicating factor: while the CR specifies funding levels by broad appropriation accounts, it does not include program-level spending tables. Instead, program details were delivered separately to the Pentagon as expressions of “congressional intent.” As a result, the Pentagon retains more discretion than usual to determine how the funds will be spent.

This opens questions about which programs will move forward as intended and which might be delayed or reshaped during execution. For now, program-level adjustments should be viewed as guidance rather than law.

Topline Procurement Remains Flat; Research & Development Loses Ground

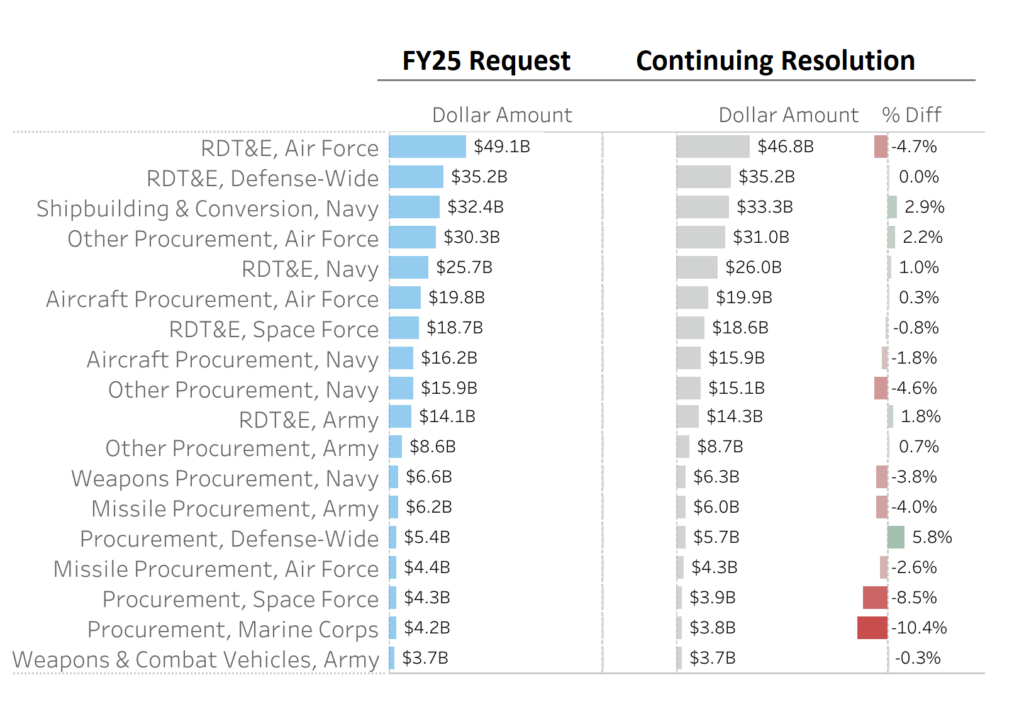

The FY25 CR provides $168.2 billion for procurement, about $688 million (+0.4%) above the request. Despite the flat procurement topline, several procurement accounts saw steep cuts, including those for the Marine Corps and Space Force. The bill also trims $1.9 billion (-1.3%) from Research, Development, Test, and Evaluation (RDT&E) accounts overall. Meanwhile, operation and maintenance funding takes a particularly hard hit, with a $5.7 billion reduction compared to the request. Military construction is also reduced by $818.4 million.

Source: FY25 U.S. Defense Budget SpotlightAir Force Plans Face Setbacks

The Air Force, which had hoped for a significant procurement boost, ends up with a modest $107 million increase, far below the $3.6 billion recommended by the Senate Armed Services Committee and the $1 billion proposed by Senate appropriators. The House, by contrast, had recommended a reduction in total Air Force procurement funding.

There was a chance a negotiated conference appropriations bill could have included a 5-10% increase for Air Force aircraft procurement, but the final bill only delivered a 0.3 percent bump. Lawmakers recommended adding a pair of F-35s, several C-130s, and two HH-60W combat rescue helicopters. Funding for additional F-15EX fighters and nine additional C-130s, as proposed by the Senate, did not materialize.

The real blow comes to the service’s R&D portfolio, which sees a $2.3 billion (4.7 percent) reduction. While both appropriations committees had proposed cuts for the Air Force, the final figure tracks more closely with the Senate Appropriations Committee’s (SAC) markup. However, the SAC would have offset its cuts with a $1.1 billion increase for the Space Force that didn’t make it into the final bill.

Several high-profile programs lost funding compared to the request, including Sentinel ballistic missile, Next Generation Air Dominance (NGAD), and the Advanced Battle Management System (ABMS). However, recapitalization efforts like the T-7 trainer and E-7 Wedgetail received additional resources.

Navy Loses Nearly $1 Billion in Procurement

The Navy’s procurement portfolio produced mixed results, with shipbuilding standing out as a rare bright spot. The Shipbuilding and Conversion account gained nearly $1 billion (a 2.9 percent increase), driven largely by an additional $1.6 billion for a third Arleigh Burke class destroyer and three Ship-to-Shore Connectors (SSCs). This helped offset the loss of one Constellation class frigate requested in FY25. In contrast, all other Navy procurement accounts were cut, with Other Procurement and Marine Corps Procurement facing the steepest reductions of 4.6 percent and 10.4 percent, respectively. A $578 million cut for Virginia-class spares and repairs led the Other Procurement reductions. Marine Corps procurement adjustments included a $176.5 million reduction for electromagnetic spectrum operations, as well as cuts to tactical vehicles, communications equipment, and weapons systems.

On the aviation side, lawmakers added four F-35Cs, one CH-53K, and two KC-130Js, but those new airframes didn’t fully offset broader reductions. The Navy lost three MQ-25s and saw reduced modification funding for several aircraft, including the F/A-18, EA-18G, F-35B/C, and MQ-4C Triton. Missile procurement also took a hit, with funding reductions for both AMRAAM and SM-6 systems.

Navy R&D funding increased 1.0 percent above the request, including an extra $150 million for the Nuclear Sea-Launched Cruise Missile (SLCM-N). However, cuts were made to the Next-Generation Jammer, EA-18G development, and SM-6 missile improvements.

Army Shows Modest Gains Favoring Aviation Programs

The Army secured a modest $265.9 million procurement increase in the final bill, an increase of 1.1 percent. Most of the growth came from aircraft procurement, which rose by $308.7 million (up 9.8 percent). That increase includes $60 million for UH-60 Black Hawks and $240 million for MQ-1C Gray Eagles. Ammunition procurement rose by $154.6 million (up 5.7 percent), and Other Procurement saw a modest $60.6 million gain (up 0.6 percent).

Missile procurement declined by $247.5 million, with notable cuts to Patriot missiles, the Indirect Fire Protection Capability, the Long-Range Hypersonic Weapon, and Javelins. Vehicle programs had a mixed outcome: gains for M109 Paladins and tactical vehicles were offset by cuts to the Armored Multi-Purpose Vehicle. Several communications systems also lost funding.

On the RDT&E side, the Army gained $248.7 million (up 1.8 percent), short of the $1.3 billion increase proposed by House appropriators. Increases focused on applied research, advanced technology development, and modernization efforts for operational systems such as the UH-60, CH-47, and combat vehicles. However, funding was reduced for prototyping and system development and demonstration.

Bottom Line

The FY25 continuing resolution is an unusual budget. It gives the Pentagon more flexibility than a standard CR, but it lacks the stability and precision of a traditional appropriations act. While some programs benefit from new-start authorities, many long-term investments, particularly in R&D, face delays or reductions.

All eyes now turn to the pending FY26 budget request, which President Trump has indicated could approach $1 trillion. It remains to be seen whether that request will clarify how the Pentagon plans to implement funding contained in the FY25 CR, but it will offer important insight into the new administration’s evolving defense priorities.

Forecast International’s U.S. Defense Budget Spotlight will continue tracking these developments in real time, providing users with an interactive view of how defense funding changes through the upcoming budget process.

More Defense Budget Data

Forecast International’s U.S. Defense Budget Forecast makes it easy to navigate the latest U.S. defense budget. The product features sorting and data visualization options and presents the entire Future Years Defense Program (FYDP) through an online interface with downloadable spreadsheets. This is the go-to service for anyone looking to save time and energy in navigating the massive Department of Defense budget.

Shaun's deep-rooted interest in military equipment continues in his role as a senior defense analyst with a focus on the United States. He played an integral role in the development of Forecast International's U.S. Defense Budget Forecast, an interactive online product that tracks Pentagon acquisition programs throughout the congressional budget process. As editor of International Military Markets – North America, Shaun has cultivated a deep understanding of the vast defense markets in the United States and Canada. He is a regular contributor to Forecast International's Defense & Security Monitor blog and has co-authored white papers on global defense spending and various military programs.