Congress is at a crossroads over the FY25 defense budget. Although the Biden administration’s FY25 budget request adhered to Fiscal Responsibility Act (FRA) spending caps, House and Senate defense committees have diverged significantly in their markups of the FY25 spending plan. The House Armed Services Committee (HASC) and House Appropriations Committee (HAC) aligned with the administration regarding topline funding levels, limiting the scope of their adjustments. In contrast, Senate committees have pushed for significant increases, advocating for billions in additional procurement and research & development funding beyond FSA limits.

For those trying to make sense of these competing proposals, Forecast International’s free FY25 U.S. Defense Budget Spotlight is a powerful tool. This new dashboard provides a comprehensive look at the key differences in funding recommendations between the House and Senate defense committees. The dashboard offers clear, side-by-side comparisons, providing insight on how the final budget may take shape and impact military procurement and research priorities for FY25. The dashboard will also be updated when lawmakers release their final versions of the FY25 National Defense Authorization Act and defense appropriations bill.

Diverging Proposals

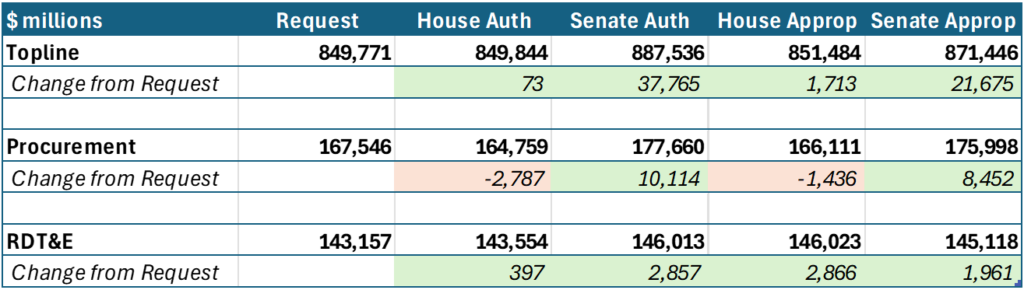

Despite leaving the Pentagon’s topline request largely unchanged, both the HASC and HAC proposed budgets that would reduce funding for military procurement. House appropriators would offset this cut with an influx of funding for Research, Development, Test & Evaluation (RDT&E).

Meanwhile, the Senate Armed Services Committee (SASC) and Senate Appropriations Committee (SAC) proposed substantial topline budget increases that would result in more funding for both procurement and RDT&E. The SASC bill would authorize about $38 billion more than the request, including $12 billion in emergency military construction funding for disaster relief efforts, which is exempt from FSA spending limits. However, the remainder of the additional funding proposed by the SASC would break the FSA limits, including a $10 billion plus-up for procurement and an extra $2.9 billion for research and development.

Senate appropriators recommended an increase of around $22 billion for the Pentagon, resulting in an additional $8.5 billion for procurement and $2 billion for RDT&E. The SAC built emergency funding directly into its budget markup, which serves as an accounting loophole to bypass FSA spending caps.

FY25 Topline and Acquisition Spending

The House and Senate appropriations bills are especially important to focus on, because appropriators ultimately have the final say in how much money the military will receive in FY25. We’ll therefore examine how the two proposed appropriations bills would impact Pentagon acquisition programs. Quantity data for the table below was pulled from Forecast International’s U.S. Defense Budget Forecast database.

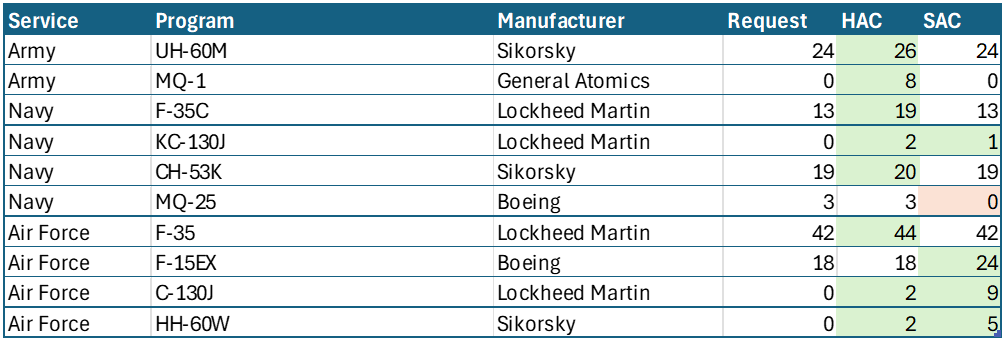

Aircraft Procurement

The SAC proposed a nearly 10 percent increase for the Air Force’s aircraft account, reflecting an influx of $1.9 billion for additional C-130J transports, a KC-130J tanker, F-15EX fighters, and HH-60W Combat Rescue Helicopters. However, the Senate cut three MQ-25 unmanned tankers and removed $718.1 million for aircraft modifications across the fleet.

In the House appropriations bill, lawmakers recommended an 11.2 percent increase for Army aircraft, primarily due to the addition of eight MQ-1 drones and a pair of UH-60M helicopters. The HAS also increased aircraft funding for the Navy and Air Force by 5.3 percent and 5.1 percent, respectively. The House markup included more modest increase for the C-130J and HH-60W than the Senate, but the House also added several F-35A and F-35C fighters.

Aircraft Procurement Quantities

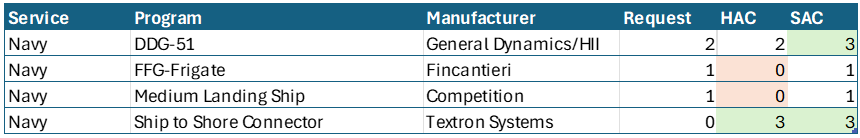

Shipbuilding

There are significant discrepancies between the House and Senate appropriations bills when it comes to warships. The Navy’s shipbuilding account was the biggest beneficiary in the Senate appropriations bill with the addition of $4.6 billion, an increase of more than 14 percent above the request. The committee added a third DDG 51 destroyer, advance procurement for LPD Flight II and LHA amphibious warships, and additional LCAC 100 Ship-to-Shore Connectors. Notably, the Senate bill also added $1.8 billion for the completion of prior year shipbuilding programs, including $1 billion in emergency funding to finish construction of Virginia class submarines procured in FY24.

Meanwhile, the House bill would reduce Navy shipbuilding funding by 2.3 percent. The legislation lacks the third destroyer proposed by the Senate. Further, the House markup zeroes out funding for the Constellation class frigate and cuts the lone Landing Ship Medium requested for the Marine Corps.

Shipbuilding Procurement Quantities

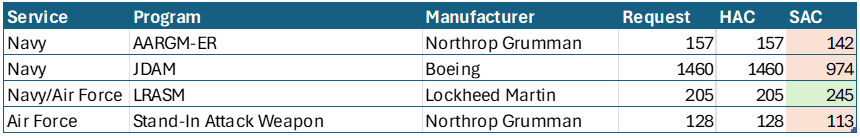

Missile Procurement

The biggest change in the HAC bill is a 17.1 percent reduction for Army missile procurement, due in large part to $626.2 million taken away from the Long-Range Hypersonic Weapon. The Air Force’s missile account is also cut by 8.2 percent in the House markup, which includes the removal of $140 million in advance procurement for the Long-Range Stand-Off Weapon (LRSO).

The Senate’s version of the bill also cuts Air Force missile funding, though by a more modest 3.8 percent. Senators provided a small increase for Army missile investment, but they reduced procurement quantities for extended-range Advanced Anti-Radiation Guided Missiles (AARGM-ER), Stand-in-Attack Weapons (SiAW), and Joint Direct Attack Munitions (JDAM). However, the Senate recommended increasing production of Long-Range Anti-Ship Missiles (LRASM) in FY25.

Missile Procurement Quantities

Vehicle Procurement

Both bills reduced funding for the Army’s Armored Multi-Purpose Vehicle (AMPV), but the changes were due to contract savings or carryover funding and didn’t impact the number of vehicles being procured.

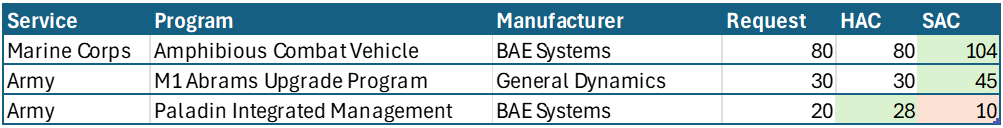

The House and Senate differ on their handling of the service’s Paladin self-propelled howitzer, with the House adding $158 million for around eight vehicles and the Senate cutting 10. The Army recently awarded contracts for demonstrations of new howitzers to potentially replace the Paladin following termination of the Extended Long-Range Cannon (ERCA) program. Senate appropriators also proposed increasing procurement of the Abrams tank and the Marine Corps’ Amphibious Combat Vehicle (ACV).

Vehicle Procurement Quantities

Research & Development

The House and Senate appropriations committees took a similar approach to adjusting the Pentagon’s research & development coffers. Both committees increased RDT&E funding for the Army, Navy, and Defense-Wide agencies, but reduced Air Force investment.

The Army saw an increase of 9.0 percent for research in the House bill, compared to a 3.0 percent increase in the Senate legislation. The House and Senate appropriations committees recommended increasing Navy RDT&E funding by 3.8 percent and 2.0 percent, respectively. Adjustments for Defense-Wide agencies were similar, totaling 4.3 percent in the House bill and 4.9 percent in the Senate’s markup.

The Senate bill includes a 4.6 percent cut for the Air Force, though $1.9 billion of this reduction comes from a classified line item used as a pass-through for external agencies. In comparison, the House bill cut Air Force research funding by 0.9 percent.

One critical difference between the chambers is with the Space Force. The House proposed a 2.2 percent cut, compared to a 5.7 percent increase in the Senate bill. Much of the Space Force research funding added by the Senate is classified.

Moving Forward

The government is currently operating under a three-month continuing resolution that runs through December 20. Congress must pass a final FY25 defense appropriations bill before that point or implement another CR before the current one expires. There is also a lingering threat of a full-year CR, which would trigger FSA sequestration cuts. An FSA sequester would reduce the budget to FY23 levels minus one percent. Our FY25 U.S. Defense Budget Spotlight indicates a full-year CR would result in a potential loss of $5.8 billion for procurement and $4.8 billion for research compared to the FY25 request. The threat of sequester is intended to serve as incentive to pass a final appropriations bill, and a full-year CR is not anticipated at this time. It’s uncertain whether Congress will negotiate a final spending bill by December, and they may extend stopgap spending into 2025 until the new Congress is seated in January.

Increasing the defense topline, as proposed by the SASC and SAC, would require some type of supplemental spending to bypass the FSA limits. The approach taken by Senate appropriators to integrate emergency spending directly into their markup means that legislation could pass in its current form without violating FSA restrictions, but House negotiators would have to sign off on the move in a joint conference bill.

Alternatively, Congress could pass a standalone supplemental, potentially as part of a Ukraine aid bill. However, an FY24 national security supplemental passed earlier this year was delayed for months due to disagreements over security assistance to Ukraine, and there may be another prolonged fight over Ukraine aid in FY25. Without emergency supplemental funding, the Pentagon budget will remain capped at around $850 billion in FY25.

More Defense Budget Data

Forecast International’s U.S. Defense Budget Forecast makes it easy to navigate the latest U.S. defense budget. The product features sorting and data visualization options and presents the entire Future Years Defense Program (FYDP) through an online interface with downloadable spreadsheets. This is the go-to service for anyone looking to save time and energy in navigating the massive Department of Defense budget.

Shaun's deep-rooted interest in military equipment continues in his role as a senior defense analyst with a focus on the United States. He played an integral role in the development of Forecast International's U.S. Defense Budget Forecast, an interactive online product that tracks Pentagon acquisition programs throughout the congressional budget process. As editor of International Military Markets – North America, Shaun has cultivated a deep understanding of the vast defense markets in the United States and Canada. He is a regular contributor to Forecast International's Defense & Security Monitor blog and has co-authored white papers on global defense spending and various military programs.

image sources

- AGM-158C flight testing begins on F-35C: Dane Wiedmann