The People’s Republic of China (PRC) self-propelled howitzer (SPH) program represents a significant effort to modernize its heavy artillery. Over the years, the PRC has continuously developed and improved its SPH systems to enhance their technological capabilities and operational efficiency. The latest addition to the program is the SH-16A, which incorporates cutting-edge technology, including an autonomous turret and laser ignition system. These innovations mark a first for this category of howitzers, enabling multiple autonomous functions that streamline operations and reduce crew workload.

The PRC’s advancements in SPH technology also aim to enhance its competitiveness in the global arms market. By offering innovative, cost-effective SPH solutions and targeting third-market countries, the PRC can position itself as a dominant force in the global artillery industry.

Origins and Timeline

At the time of its founding, the People’s Liberation Army (PLA) possessed a limited number of SU-76 and other self-propelled artillery models. While these provided some armored capabilities, the small number of SU-76s proved unsustainable in an increasingly competitive international landscape.

Economic and industrial developments in the 1950s allowed the PRC to begin research on track-type self-propelled artillery. Drawing from Soviet designs, the PRC developed its first-generation domestic SPH, the 70-type 122mm, throughout the 1960s. This model mounted a Chinese derivative of the Soviet 122mm gun onto the newly developed 63-Type track-type armored transport vehicle. Since then, the PRC has steadily advanced its SPH models, including 105mm, 122mm, and 155m variants. The modern SPH project culminated in the unveiling of the SH-16 in February 2024. A further refined and modular version, the SH-16A, was publicly revealed in November 2024.

This new generation of SPH innovation indicates China’s prioritization of technological advancements, efforts toward standardizing armaments across platforms, and a focus on the international export market. The last several major iterations of Chinese SPHs have adopted the NATO-standard 155mm caliber, aligning with international military norms and increasing their appeal to foreign buyers. By transitioning away from smaller calibers and unifying its artillery platforms, the PRC aims to simplify logistics, enhance interoperability, and improve the overall combat effectiveness of its SPH systems.

Budget and Partners

Due to the secretive nature of the Chinese Defense Ministry information on the SPH project’s budget and partnerships remains limited. China North Industries Group Corporation (Norinco) serves as the primary manufacturer for Chinese SPH systems. As a Chinese State-Owned Enterprise (SOE), information regarding its budget, suppliers, and project partners is scarce. However, Norinco is likely collaborating with other Chinese SOEs to source components for its SPH projects. Based on a Pakistani export order, the discounted price for a single SH-15 in 2019 was $2.1 million.

Norinco’s close partnership with Pakistan is notable. One of the defining features of this collaboration is the emphasis on technology transfer. Pakistan’s deal with Norinco for SH-15 shipments included the transfer of technologies that allow Pakistan to produce the SH-15 domestically. The nature of this close and evolving relationship signals that Pakistan may already be involved, or may soon become involved, in the development and production of the SH-16 and future models.

Export Market and Outlook

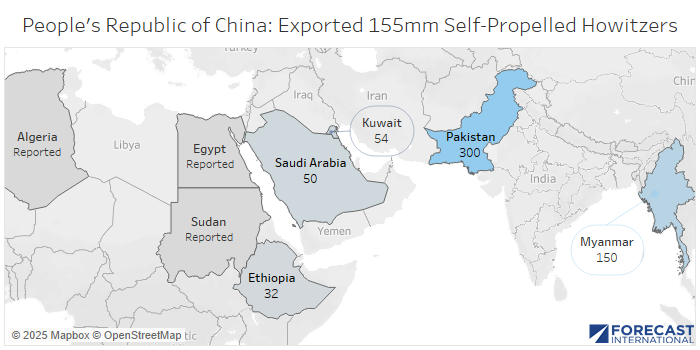

The PRC’s SPH export market has witnessed significant success, with multiple iterations of its artillery systems being sold internationally. The PRC has exported 155mm SPH systems to Algeria, Egypt, Pakistan (300 units), Ethiopia (32 units), Myanmar (150 units), Kuwait (54 units), Saudi Arabia (50 units), and Sudan. The SH-15 experienced notable export achievements in 2024, with 600 units deployed by the PLA and large sales to key allies.

Despite this success, the export outlook remains mixed. Factors such as an underdeveloped procurement system, limited domestic defense competition, and external geopolitical pressures – including sanctions, arms control treaties, and Western influence over third-market countries – could impede future expansion.

To counter these challenges, the PRC is employing a four-pronged strategy. First, it is refocusing on civil-military fusion to enhance production efficiency. This policy enables the PRC to overcome the limitations of an underdeveloped procurement system and limited competition by eliminating barriers between civilian, commercial, and military sectors. Second, the PRC is prioritizing cutting-edge technology, such as automated turrets and laser ignition, to increase export competitiveness. Third, the PRC is leveraging aggressive pricing strategies to undercut Western and Russian competitors. The $2.1 million price tag of the SH-15 is significantly less than comparable SPH models (France’s CAESER is $6 million), which makes it particularly attractive to third-market countries. Fourth, it is tailoring its marketing efforts to meet specific buyer needs. For example, during negotiations with Pakistan, the PRC emphasized the SH-15’s ability to fire 155mm shells with nuclear warheads, capitalizing on Pakistan’s security concerns with India.

Beijing’s arms market is increasingly targeting developing countries, particularly in Africa. In November 2024, the PRC officially surpassed Russia as the largest arms exporter to Sub-Saharan Africa. As Russia remains preoccupied with the ongoing conflict in Ukraine, the PRC has positioned itself as a competitor in traditional Russian markets. At Eurosatory, China showcased its commitment to producing SPH systems with NATO-standard 155mm artillery to enhance its land-based weapons exports to former Russian clients. The SH-16A represents the PRC’s latest effort to carve out a larger share of the international SPH market.

Anna Miskelley has cultivated a deep interest in global security, emerging technologies, and military systems throughout her academic and professional career. She is currently a Defense Industry Analyst with Forecast International.

Before joining Forecast International, Anna was a research fellow at the Center for Security, Innovation, and New Technology, where she researched the impact of artificial intelligence on U.S. nuclear command and control systems. Proficient in Mandarin Chinese, Anna has published research on topics including strategic stability, internal Chinese politics, and artificial intelligence.