Source: U.S. Army

Source: U.S. ArmyThe FY25 National Defense Authorization Act (NDAA), signed into law in December, sidestepped calls from some lawmakers for the policy bill to increase the Pentagon’s topline budget, but the legislation offers a look into congressional priorities for defense acquisition. Lawmakers increased authorization for investment in missile defense programs and counter-unmanned aerial systems capabilities, while also bolstering aircraft programs and Indo-Pacific priorities. However, the Navy’s shipbuilding programs saw mixed results in the NDAA, despite intentions to rapidly expand the fleet.

The NDAA adheres to the Biden administration’s topline request of $883.7 billion for national security, including $849.9 billion for the Pentagon and $33.3 billion for national security programs in the Department of Energy. The proposed bill aligns with the spending caps established by the Fiscal Responsibility Act (FRA). Notably, the final version of the NDAA omits a significant funding boost recommended by the Senate earlier in the FY25 budget process.

The compromise authorization bill includes modest increases of $1.5 billion for procurement and $611.5 million for RDT&E, as outlined in Forecast International’s FY25 U.S. Defense Budget Spotlight. Another $865.1 million is added for military personnel. These increases are offset by a $1.9 billion reduction in operation and maintenance funding.

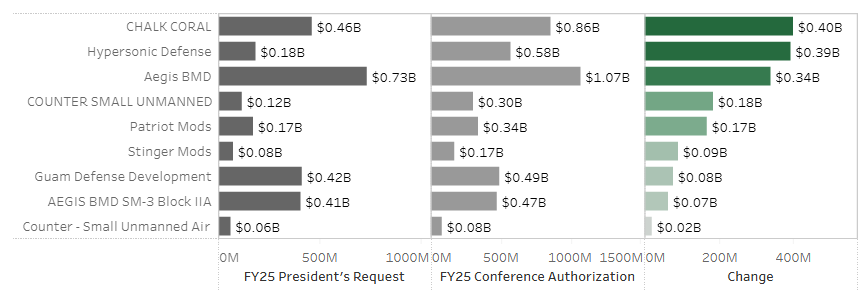

Strong Congressional Support for Air and Missile Defense

Despite the lack of a topline budget increase for the Pentagon, the NDAA showed support for air and missile defense programs, which have also been highlighted as a key priority for the new administration. Congress added $393 million to accelerate development of the Glide Phase Interceptor (GPI), a hypersonic missile defense program that Northrop Grumman was recently selected to develop. The legislation includes an additional Patriot launcher and funding for Stinger Block I missile upgrades. Lawmakers also added $250 million to restore SM-3 Block I interceptor missile production, as well as $167.1 million for TPY-2 radar components to fill an unfunded priority from the Missile Defense Agency.

Air and Missile Defense Gains in the FY25 NDAA

Several increases specifically target Indo-Pacific defense, including $165.7 million for development of a Guam defense system. A provision in the bill requires the Pentagon to submit multiple reports on the status of protecting the island from Chinese and North Korean missile threats. The legislation also adds $400 million for Chalk Coral, a classified Navy program that is developing a non-traditional find, fix, track and targeting (F2T2) capability. This plus-up was one of U.S. Indo-Pacific Command’s unfunded priorities in FY25.

The NDAA is also supportive of C-UAS capabilities, which are an increasingly important component of the Pentagon’s broader air defense portfolio. Specifically, lawmakers added $184.8 million for Coyote interceptors, made by RTX, which was the Army’s number one unfunded priority in FY25. Another $50 million was added for C-UAS capabilities for U.S. Africa Command, and $20 million for Army C-sUAS development.

The legislation was finalized before President Trump issued an executive order last month to develop an Iron Dome for America. That ambitious effort stands to further increase U.S. investment in air and missile defense systems, and those changes will be addressed in future budget requests and congressional markups.

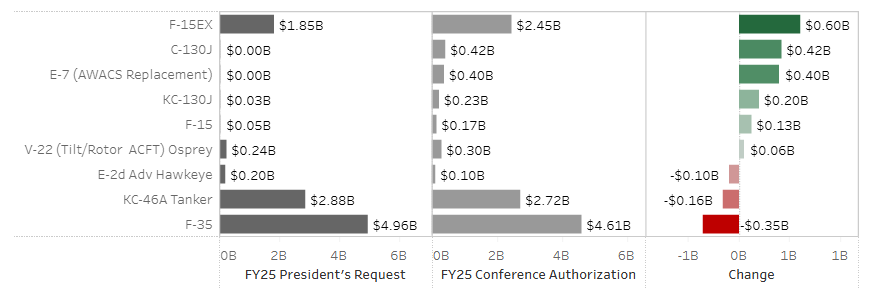

Aircraft Adjustments

The Air Force is the primary beneficiary of aircraft procurement adjustments in the NDAA. The bill authorizes an additional six F-15EX fighters, four C-130J transports (including two LC-130Js for polar operations), a net increase of one C-40B, and $400 million to accelerate procurement of E-7 aircraft to replace the E-3 AWACS. The bill also adds $126.3 million to prevent the retirement of F-15Es and increases funding available for aircraft spare parts and F-16 engines. The bill cut $345.3 million for F-35 procurement, which did not impact the number of aircraft being procured.

Key Aircraft Procurement Funding Adjustments in the FY25 NDAA

The Navy also received funding for two additional KC-130J aerial tankers, and the bill authorizes procurement of 20 CH-53K helicopters, up from 19 in the request. Congress cut funding requested to shut down the E-2D production line. Congress added two E-2Ds to the budget in FY24 and another four aircraft desired by the Navy remain unfunded in the outyears. Those aircraft could potentially be added in a future budget request or inserted by Congress.

Some of the Air Force’s aircraft development programs struggled in the bill due to program delays, and lawmakers cut $140.6 million for the Survivable Airborne Operations Center (SAOC) and $108.5 million for the VC-25B executive transport (Air Force One).

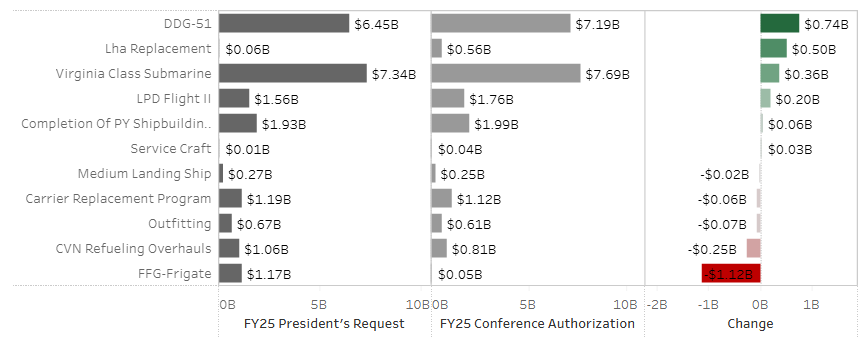

Mixed Signals on Navy Shipbuilding

The Navy’s shipbuilding account, frequently a target of major increases during the defense budget process, was effectively flat in the NDAA. For comparison, the Senate Armed Services Committee recommended a $4.2 billion boost compared to the request, reflecting a 13 percent jump.

On the positive side for the Navy, the bill authorizes the balance of funding ($700 million) for a third DDG 51 destroyer that was initially added to last year’s budget, as well as advance procurement for a third destroyer in FY26. The bill also adds advance procurement for the LPD Flight II program and the LHA 10 amphibious warship, as well a repair, berthing, and messing barge (YRBM).

Shipbuilding Adjustments in the FY25 NDAA

However, Congress removed funding for the only Constellation class frigate requested in FY25, citing program delays, leaving only $50 million for small surface combatant shipyard infrastructure and workforce development. The first Medium Landing Ship (LSM) for the Marine Corps was also removed from the bill, but Congress added funding for procurement of a non-developmental LSM in its place. A provision in the bill also prevents the Navy from awarding an LSM construction contract until the basic and functional design of the ship is complete (this provision does not apply to the non-developmental ship funded in the bill).

Investments and Cuts in Weapons Programs

Congress’ budget adjustments reflect a strong emphasis on precision strike and naval munitions. The Army receives funding for 70 additional Precision Strike Missiles (PrSM) and $35 million for long-range precision fires technology, reinforcing the push for deep-strike capabilities. The service’s Long-Range Hypersonic Weapon (LRHW) is subject to a $52.3 million reduction for support costs, but the procurement request for the weapon remains mostly intact. Congress authorized $691.9 million for the LRHW in FY25, a steep jump over the FY24 enacted level of $62.8 million.

Naval munitions see a boost with 21 additional Naval Strike Missiles and $50 million to expand MK-54 torpedo production, enhancing anti-ship and undersea warfare capabilities. On the strategic weapons front, Congress adds $252 million for the nuclear-armed sea-launched cruise missile (SLCM-N), which lawmakers have kept alive despite the Navy’s effort to scrap the program.

The Air Force also received $200 million for risk reduction work on the Sentinel ballistic missile, which has faced significant cost growth. Congress also directed the Pentagon to ensure strong government oversight and competition throughout the Sentinel program to help limit future cost growth and keep the program on track.

The Space Force saw reductions for both procurement and research and development programs. On the procurement side, lawmakers stripped $323.6 million for the GPS II Follow-on program. In the research account, the service saw cuts for Protected Tactical Services, Medium Earth Orbit and Low Earth Orbit missile tracking systems, Enterprise Ground Services, and Evolved Strategic Satcom, among several other minor reductions.

All Eyes on Congressional Appropriators

While the adjustments in the NDAA offer insight into congressional priorities, appropriators will determine the size of the final Pentagon budget. The House appropriations bill aligned with the administration’s request, while the Senate Appropriations Committee proposed an additional $21 billion. However, increasing defense spending beyond the Fiscal Responsibility Act’s caps would require new legislation, an emergency supplemental bill, or an alternative approach.

One option now being pursued is using the budget reconciliation process, which allows for a simple Senate majority to pass bills that impact taxes, spending, or the debt. A recent proposal from the Senate Budget Committee would add $150 billion for defense over the coming years, while Sen. Roger Wicker (R-Miss.), the new Senate Armed Services Committee Chairman, has suggested adding up to $200 billion to the Pentagon budget over two years. An influx of funding could support programs like the Air Force Next Generation Air Dominance (NGAD) fighter, domestic missile defense expansion, and increasing Navy shipbuilding rates. Reconciliation is not intended for modifying discretionary accounts typically handled through the regular appropriations process, such as the defense budget.

Forecast International’s FY25 U.S. Defense Budget Spotlight offers insights into these high-level funding shifts within the Pentagon’s acquisition budget. More detailed information is available in our U.S. Defense Budget Forecast database, an online tracking tool that follows every line item in the Pentagon’s procurement and RDT&E accounts throughout the entire congressional budget process.

Shaun's deep-rooted interest in military equipment continues in his role as a senior defense analyst with a focus on the United States. He played an integral role in the development of Forecast International's U.S. Defense Budget Forecast, an interactive online product that tracks Pentagon acquisition programs throughout the congressional budget process. As editor of International Military Markets – North America, Shaun has cultivated a deep understanding of the vast defense markets in the United States and Canada. He is a regular contributor to Forecast International's Defense & Security Monitor blog and has co-authored white papers on global defense spending and various military programs.

image sources

- 5-7 ADA hosts German Minister of Defense in Poland: U.S. Army