A Boeing F-15EX Eagle II on the flight line at Selfridge Air National Guard Base, Michigan in June. Image – 2nd Lt. Elise Wahlstrom via DVIDS.

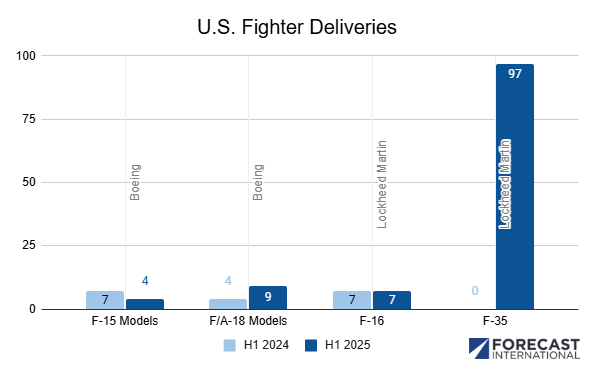

Recent second-quarter reports from the U.S.’s two prime fighter producers—Boeing and Lockheed Martin—reveal some strengths, but also underlying challenges at the midpoint of 2025. Together, they delivered 117 fourth- and fifth-generation fighters during the period, including Boeing’s F-15 and F/A-18, and Lockheed Martin’s F-16 and F-35.

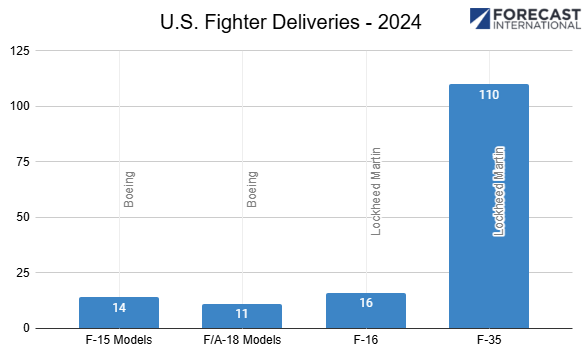

Boeing’s F-15 deliveries have slowed considerably compared to the same time last year. Deliveries are down by nearly 50 percent through the second quarter. The U.S. Air Force continues to receive the modernized F-15EX Eagle II with the first jet from Lot 2 production, and ninth overall, turned over earlier this year.

Despite the slip, the F-15EX program received a substantial boost from the Pentagon for FY26. The program of record now stands at 129 fighters, up from 98, with increased funding via the DoD’s budget request and the Reconciliation bill. On the export front, Boeing will build 25 units—with an option for 25 more—for Israel. Under the $5.2 billion deal, deliveries are scheduled to begin in 2031.

Boeing aims to increase F-15EX production to 24 units annually by 2026. However, the company will need to make up ground quickly just to match its 2024 total of 14 deliveries.

As a positive sign, Boeing has more than doubled the F/A-18 Super Hornet delivery rate compared to last year. If sustained, Boeing will easily surpass its 2024 total of 11 F/A-18 deliveries.

Barring any unlikely export orders, the Super Hornet production line will shutter after wrapping work on the final U.S. Navy procurement contract signed in March 2024. That modification, worth $1.1 billion, covers the last 17 new-build F/A-18E/Fs for the service with planned deliveries by 2027.

Concurrently, Boeing continues work on the F/A-18 service life modification (SLM), upgrading aging F/A-18 fighters to the Block III standard. Since 2019, Boeing has delivered approximately 42 SLM fighters, doubling their flight hour lifespan.

Finding renewed interest abroad for the F-16, Lockheed Martin has accumulated an impressive export orderbook for the Block 70/72 variants. Production rates out of the Greenville, South Carolina, plant have increased steadily since its opening in 2019, with deliveries tripling from 2023 to 2024. Yet, deliveries still trail Lockheed Martin’s stated production goals.

In 2024, Lockheed Aeronautics President Greg Ulmer forecasted that some 36 Block 70/72 F-16s would be built in 2025, with further increases expected for 2026. But, only seven units were delivered in the first half of 2025, suggesting the company may fall short of its production target.

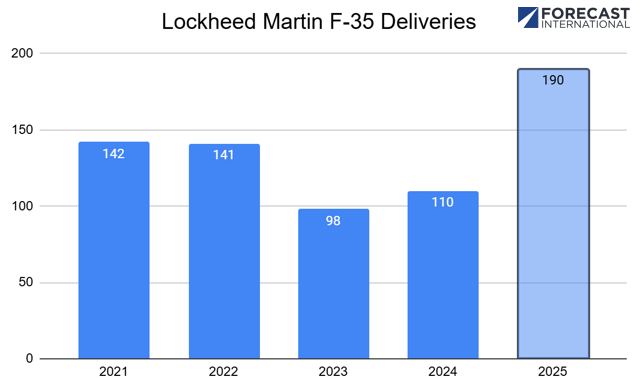

Meanwhile, delivery bottlenecks stemming from delays with integrating TR-3 hardware and software requirements needed for the F-35 Block 4 upgrade are beginning to ease. From July 2023 through July 2024, the Pentagon refused delivery of “truncated” F-35s, resulting in 72 aircraft sent to storage.

That backlog was cleared May 1, with Lockheed officials claiming the TR-3 package is now combat-ready, though formal DoD approval is still pending. Lockheed delivered 97 F-35s in H1 2025, building on a record-breaking April. The pace keeps the company in a healthy position to meet its delivery goal of 170 to 190 F-35s for 2025.

While production continued during the delivery pause, it’s unclear how much the backlog affected manufacturing rates. The subsequent delivery surge likely included both new-build and previously-stored fighters, which helps to explain why 2025 deliveries could exceed the F-35’s 156-unit annual production rate.

Lockheed Martin projects to deliver between 170 and 190 F-35s in 2025.

As the F-35 delivery pause demonstrates, delivery numbers are not a direct reflection of manufacturing output. Nonetheless, they do help illustrate broader production health. Both Boeing and Lockheed Martin are under pressure to increase deliveries, meet schedules, and avoid further erosion of trust with government buyers.

Fighter unit costs are likely to rise, particularly if production goals are unmet, potentially discouraging mult-year or large-quantity orders. While the defense segment has generally benefited from short-term insulation from tariffs, cost increases in the downstream supply chain remain a risk.

Performance concerns amid a difficult economic climate could be influencing future procurement decisions. In June, Navy Secretary John Phelan said planned budget cuts to the sixth-generation F/A-XX program were due to a loss of confidence in industry based on cost overruns and timeline issues. He also expressed doubt that U.S. primes could support two simultaneous sixth-generation fighter programs.

Adding to these pressures, more than 3,200 workers from Boeing’s fighter production facilities began a strike on August 4 over contract disagreements. While Boeing leadership downplayed potential effects and communicated plans to utilize non-union workers, the strike could disrupt F-15 and F/A-18 output.

Further complicating F-15EX fielding, recent reports unveiled fuel venting problems in some new Air Force jets. A combined Boeing and Air Force team is investigating the issue, but it’s unclear whether complications extend back to the production line. Given the downward F-15 delivery trend for the half, any additional slowdown will make recovery difficult in the second half of 2025.

A former naval officer and Seahawk helicopter pilot, Jon currently leads the Military Aerospace and Weapons Systems group at Forecast International. He specializes in current and emerging military fixed and rotary-wing aircraft. With over a decade of experience in military aviation, operations, and education, he forecasts a diverse range of defense and naval systems.

Influenced by his time as a former Presidential Management Fellow and International Trade Specialist at the Department of Commerce, Jon gained insights into government operations and global markets.

Before joining Forecast International, he served as an NROTC instructor and Adjunct Assistant Professor at the University of Texas, teaching undergraduate courses in naval history, navigation, defense organization, and naval operations and warfare.