The U.S. Navy released its latest long-range shipbuilding strategy, which outlines construction and retirement plans for the service’s fleet over the next 30 years. The strategy document encompasses two potential outcomes based on how much funding is provided over the coming decades.

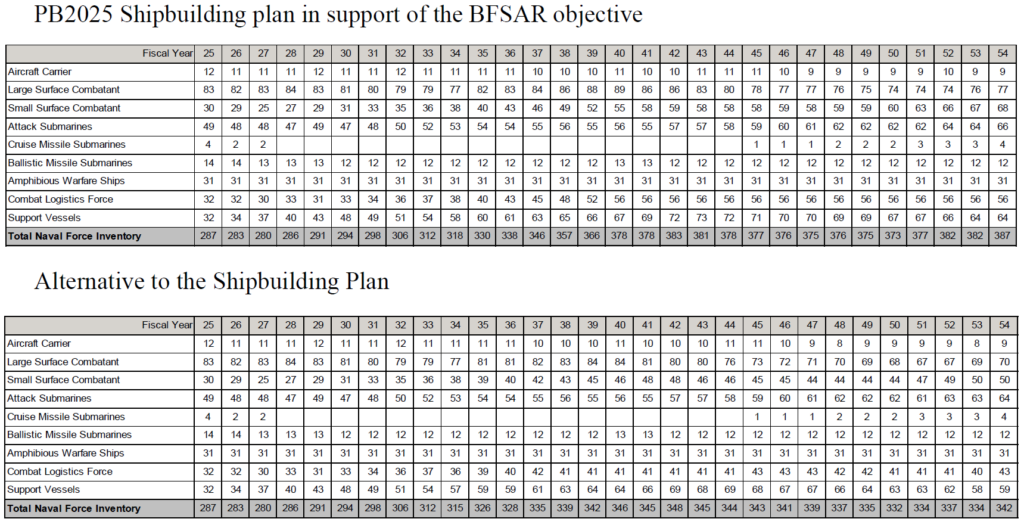

The first option, which is designated as the Navy’s official shipbuilding plan, reflects the service’s goal of reaching a fleet of 381 ships in support of the National Defense Strategy. This goal aligns with a Battle Force Ship Assessment and Requirement (BFSAR) report released in June 2023. The second option, which is labeled as an alternative to the official shipbuilding plan, shows what would happen to the future fleet under a resource-constrained environment with zero real budget growth above inflation.

The Navy’s optimum plan would see the manned battle force grow to over 330 ships in the mid-2030s, reaching 377 ships by 2045. The resource-constrained alternative would result in a fleet of 343 ships in 2045, which is around 10 percent smaller than the Navy’s goal. That option tops out at 348 ships in 2042, while the official plan would see the force continue to grow to 387 ships in 2054.

The biggest difference between the two approaches is that the resource constrained plan supports fewer surface warships – specifically frigates and Littoral Combat Ships – and fewer combat logistics force ships. Both options support similar submarine fleets and a total of 31 amphibious warships for the Marine Corps.

The dual-path strategy is an improvement over recent shipbuilding plans that outlined three alternatives based on resource levels. The latest strategy more clearly outlines the fleet the Navy wants, as well as the consequences of failing to adequately fund its construction plans.

In addition to manned ships, the strategy says the Navy could field between 89-143 unmanned platforms by 2045. The number of unmanned platforms will be adjusted as new capabilities are developed and integrated into the fleet. The 2023 BFSAR report outlined an objective of 134 unmanned platforms, comprising 78 unmanned surface vehicles and 56 extra-large unmanned undersea vehicles.

The new shipbuilding strategy also describes the Navy’s plan to decommission 19 ships in FY25, 10 of which would be removed from service early. If approved by Congress, the early departures will include two Littoral Combat Ships, two cruisers, four Expeditionary Fast Transports, one amphibious dock landing ship, and one Expeditionary Transfer Dock.

FY25_Long_Range_Shipbuilding_PlanShaun's deep-rooted interest in military equipment continues in his role as a senior defense analyst with a focus on the United States. He played an integral role in the development of Forecast International's U.S. Defense Budget Forecast, an interactive online product that tracks Pentagon acquisition programs throughout the congressional budget process. As editor of International Military Markets – North America, Shaun has cultivated a deep understanding of the vast defense markets in the United States and Canada. He is a regular contributor to Forecast International's Defense & Security Monitor blog and has co-authored white papers on global defense spending and various military programs.