With one of the most high-profile air shows of 2025 days away in Paris, discourse in aerospace circles is turning to anticipating the major storylines that will dominate the event.

While global air shows typically generate attention-grabbing headlines related to major commercial carrier deals, defense topics often play a formative role as ongoing worldwide military operations and conflicts thread—at times an uneasy—undercurrent to the gathered aerospace and defense industry.

The pattern follows this year with several hot issues that underscore growing worldwide defense investments.

Nearing three and half years in, the war in Ukraine is still shaping the understanding of advanced technology in asymmetric warfare. Ukrainian forces continue to challenge traditional warfare concepts by employing uncrewed systems against more expensive and conventional platforms to great effect in the air, land, and sea domains.

Only days ago, Ukraine conducted a surprise drone attack on strategic Russian bombers some 3,000 miles inside Russia. Since the last Paris Air Show in mid-2023, Hamas-led attacks in Israel catalyzed a significant military escalation in Gaza, where intense fighting and humanitarian fallout continue.

Even after Trump’s announcement last month that the U.S. will cease attacks against Houthi rebels in the Red Sea and Bab-al Mandab Strait, the U.S. Navy continues to perform unusually high OPTEMPO combat patrols and strategic deterrence with three carrier strike groups on location between the Middle East and Indo-Pacific regions.

With this context in mind, Forecast International anticipates the following topics to lead the defense focus at Le Bourget.

The Trump Effect

Since early February, the Trump Administration’s tariff policies have introduced widespread variability and a general shakeup of the global economic order. Most recently, the White House imposed a 50 percent tariff on steel and aluminum imports on June 4–imports from the U.K. remain at 25 percent.

Trump has consistently criticized NATO allies for inadequate defense commitments. His policy emphasizes pushing European countries to boost defense contributions and reduce reliance on U.S. security provisions.

Will we see moves that indicate Europe is shifting toward defense self-sufficiency and more investments in domestic defense programs?

Dan Darling, Forecast International’s VP of Market Insights, suggests any level of European self-sufficiency is “nearly a full decade–or more” away. He adds that the “Trump effect” is forcing European NATO partners to “take a hard look at their responsibilities and their strategic backyard.”

However, he believes any enduring moves by Europe are likely to come from a significant landscape shift that has yet to happen. Moreover, a resolution to the Russo-Ukrainian War, the election of defense-skeptic officials, or an economic recession could quickly weaken commitments to increased European defense spending.

In the face of tariff uncertainty, most major defense programs have remained relatively insulated over the past couple of months, and initial disruption fears have not materialized to the extent that many have thought. This is likely due to deeply integrated global supply chains and the long-term investments and planning required to field specialized military systems. According to Darling, Europe “will not have much choice but to continue buying select American systems” in the near term.

Nonetheless, the tone that prime European defense companies or defense ministries strike in Paris could be telling. Will any announcements or statements suggest conciliatory feelings or double down on investing in indigenous capabilities?

Sixth-Gen Fighters

The three leading sixth-generation fighter programs in the world are expected to take center stage in Paris. In March, President Trump announced that Boeing would build the F-47 as part of the U.S. Air Force’s Next Generation Air Dominance (NGAD) program, with an initial flight planned before the end of Trump’s term.

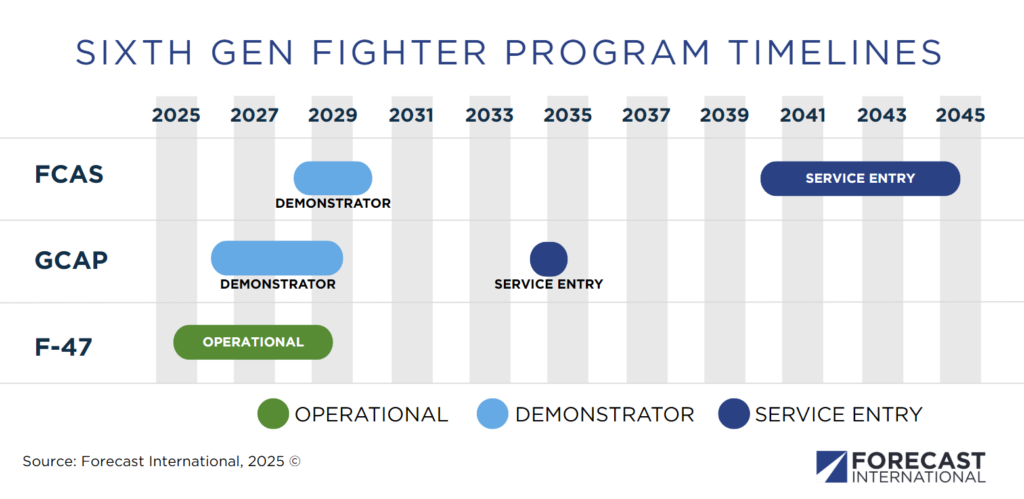

Subsequent details revealed that Boeing and Lockheed Martin accrued hundreds of flight test hours on NGAD experimental aircraft since 2020, suggesting that the U.S. is leading in the race to field a sixth-gen fighter. While the U.S. Air Force has indicated an “operational” timeline for the F-47 from 2025 through 2029, how that translates to actual capabilities remains unclear.

Nonetheless, even with a skeptic’s view of the F-47 timeframe, the U.S. will likely precede the two European-based initiatives in introducing the first next-generation fighter.

The two competing European-based sixth-gen fighter projects will look to steal some NGAD spotlight and appeal to prospective international interest in Paris. The Global Combat Air Program (GCAP)—the U.K., Italy, and Japan’s entry with a service entry target of 2035—appears to be on steadier footing compared to Germany, France, and Spain’s Future Combat Air System (FCAS).

FCAS, by comparison, has experienced more public instability related to work share disagreements. This has led, in part, to slips in the FCAS introduction from 2040 to possibly 2045 or later.

Some have argued that two competing European initiatives are unrealistic based on the necessary funding and development effort required to field a new advanced fighter. Anticipate this idea to play out in Paris as the industrial participants and partnered nations position themselves in the sixth-gen fighter race.

Framework agreements, work share approvals, and technological progress aside, GCAP and FCAS will live or die based on hard funding. Developing and fielding a new-age fighter and related systems remains a monumentally expensive endeavor. Total program estimates vary widely, with tens of billions of dollars required as a general figure and single fighter units likely hundreds of millions apiece.

If the air show hosts any significant funding announcements for either program, it could signal a meaningful swing in momentum.

UCAVs

As a related component to GCAP and FCAS, our team expects updates on loyal wingmen or unmanned combat aerial vehicles (UCAVs) that could operate in conjunction with current and future manned fighter aircraft.

As part of the broader family of systems approach, GCAP and FCAS involve dedicated work on accompanying UCAVs. Yet, fairly little is known about how independent European UCAV work will integrate with GCAP and FCAS efforts.

Airbus and Dassault Aviation—both industrial partners in the FCAS program—are advancing UCAV projects through the Wingman concept and a drone built on the nEUROn demonstrator. Additionally, Satnus, a joint venture from Spain, is flight-testing remote carriers to support FCAS.

Likewise, industrial participants from Japan and the U.K. are exploring UCAV options to support a GCAP fighter. Mitsubishi Heavy Industries has unveiled multiple concepts, while BAE Systems is working on attritable systems known as Autonomous Collaborative Platforms (ACPs).

Wrap-up

Several other major defense initiatives warrant attention. Korea Aerospace Industries and Turkish Aerospace Industries are likely to highlight their progress on new fighter offerings and garner interest in their respective KF-21 and Kaan fighters.

Finally, a turn to rotorcraft. News surrounding the NATO Next Generation Rotorcraft (NGRC) initiative, which could replace approximately 1,000 helicopters between 2035 and 2040, has been quiet, but development continues.

Concept study findings from Airbus, Leonardo, and Sikorsky are due this fall. Several NATO partners are involved, representing a significant international venture and a crucial perspective from which to view any unfolding referendum on European defense independence.

Lastly, the flying demonstration schedule, likely to be published sometime in the preceding week, could reveal specifics as to which airframers are leveraging the marquee airspace to market their capabilities to any gathered nations in need of combat air fleet modernization.

Join Forecast International at the Paris Air Show to gain valuable insight into the evolving dynamics of the global defense market. Traditionally regarded as insulated from broader economic fluctuations, the defense sector is now increasingly impacted by global economic forces. Tariffs, trade disputes, and rising economic nationalism are introducing new complexities that affect the stability, cost-efficiency, and resilience of critical defense programs.

For over 50 years, Forecast International has been a trusted authority in aerospace and defense intelligence. Our mission is simple yet vital: to equip industry leaders with the data-driven insight and strategic foresight needed for confident, informed decision-making. Visit us at Hall 3, Booth C164 to learn how our expert analysis can strengthen your planning and elevate your strategy.

Schedule a time with Jon in Paris.

A former naval officer and Seahawk helicopter pilot, Jon currently leads the Military Aerospace and Weapons Systems group at Forecast International. He specializes in current and emerging military fixed and rotary-wing aircraft. With over a decade of experience in military aviation, operations, and education, he forecasts a diverse range of defense and naval systems.

Influenced by his time as a former Presidential Management Fellow and International Trade Specialist at the Department of Commerce, Jon gained insights into government operations and global markets.

Before joining Forecast International, he served as an NROTC instructor and Adjunct Assistant Professor at the University of Texas, teaching undergraduate courses in naval history, navigation, defense organization, and naval operations and warfare.