In a scathing assessment of the F-35 Joint Strike Fighter effort and associated contractors, the Government Accountability Office (GAO) published a 54-page report on the program’s recent performance. The federal agency identified troubling trends related to modernization efforts for the F-35 Block 4 upgrade, related delivery underperformance, and failed contract requirements. Below are some of the leading highlights.

- All 110 F-35s delivered during 2024 were late by an average of 238 days.

- All 123 Pratt & Whitney F135 engines delivered during 2024 were late by an average of 155 days.

- F-35 Block 4 upgrades are $6 billion over estimates and at least five years behind schedule.

- The DoD paid F-35 contractors hundreds of millions to improve delivery timeframes while they continued to underdeliver.

- Full TR-3 combat capability isn’t expected until 2026, even after the Pentagon resumed deliveries in July 2024.

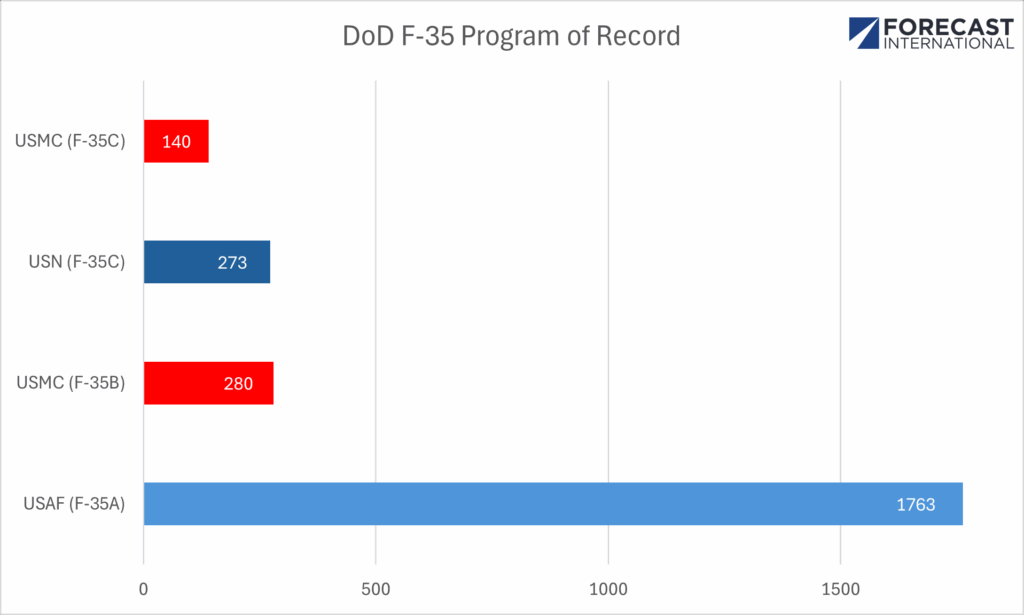

The F-35 program is the DoD’s most ambitious and wide-sweeping weapon system initiative, with a 77-year program service life and total program estimates of $2.1 trillion. The overall U.S. acquisition plan calls for 2,456 production F-35s across all three variants fielded by the Air Force, Navy, and Marine Corps.

According to Lockheed’s F35.com website, over 1,230 fighters were delivered to all customers as of September 2025. Of that figure, roughly half were sent to DoD customers, slightly over a quarter of the total planned procurement since production began in 2006.

DoD delivery problems have emerged as an Achilles heel for Lockheed Martin in recent years. Beginning in July 2023, deliveries were paused due to Technology Refresh 3 hardware and software issues that precluded new fully combat-capable F-35s. Although the Pentagon resumed accepting aircraft a year later, the GAO found that the reason was, in part, to ensure that potentially over 100 F-35s–some $9 billion worth of aircraft–did not remain parked at the contractor’s facility.

Moreover, the GAO indicates that fully combat-capable TR-3 F-35s, that afford some Block 4 features, will not be ready until sometime in 2026–an admission that implies that new F-35s from mid-2023 through 2025 will at best afford “limited combat capability” and likely serve as non-combat training aircraft.

Notably absent, the GAO did not mention another potential factor affecting future F-35 deliveries, integrating the next-generation AN/APG-85 Active Electronically Scanned Array (AESA) radar system. A March letter from Lockheed’s CEO, dated from March, to Air Force leadership reportedly stated that the manufacturer was exploring options to work around possible delays related to the APG-85 and future F-35 production lots. It remains unclear if upcoming production could be affected at all, but the letter itself introduces another troubling layer to the F-35 delivery outlook.

F-35 delivery performance woes are a significant consideration in the broader discourse surrounding F-35 acquisitions. The F-35 has become an outsized political flashpoint during the second Trump administration, with 47 total F-35s requested for FY26–down from the Biden administration’s FY25 request for 68 fighters.

In a July letter, responding to the FY26 reduced F-35 request, 17 retired Air Force flag officers petitioned Congress to allocate funding for 75 F-35As for the service, writing, “We cannot emphasize enough the importance of rapidly acquiring F-35As to achieve the Air Force’s requirement of 1,763 aircraft.”

For several years, Air Force leaders have argued that the U.S. must maintain a steady procurement drumbeat of 72 new fighter aircraft per year to help offset net losses from retiring legacy aircraft, deter China, and strengthen the industrial base for future conflict.

Yet, the continued subpar delivery performance, modernization delays, and failure to execute contract obligations raise the question of whether the American fighter industry can realistically meet current and future demand signals.

For its part, the DoD responded agreeably by concurring with four of the six recommendations proposed by the GAO. For the first and most pressing recommendation, the DoD “will continue to evaluate the production capacity of Lockheed Martin to meet planned delivery schedules on time.” In addition to reviewing incentive strategies, this could help curb unearned payments. Yet, the fact remains that the U.S. government holds few to zero sticks or carrots to affect changing the pace of F-35 deliveries.

Despite legitimate fiscal and contractor performance concerns, the F-35 remains the most advanced combat-proven fifth-generation fighter aircraft available, and perhaps the only viable U.S. fielding option for maintaining air superiority and effective deterrence. This puts defense decision makers between a rock and a hard place, particularly if the F-35 program, in the GAO’s words, “continues to overpromise and underdeliver.”

A former naval officer and Seahawk helicopter pilot, Jon currently leads the Military Aerospace and Weapons Systems group at Forecast International. He specializes in current and emerging military fixed and rotary-wing aircraft. With over a decade of experience in military aviation, operations, and education, he forecasts a diverse range of defense and naval systems.

Influenced by his time as a former Presidential Management Fellow and International Trade Specialist at the Department of Commerce, Jon gained insights into government operations and global markets.

Before joining Forecast International, he served as an NROTC instructor and Adjunct Assistant Professor at the University of Texas, teaching undergraduate courses in naval history, navigation, defense organization, and naval operations and warfare.