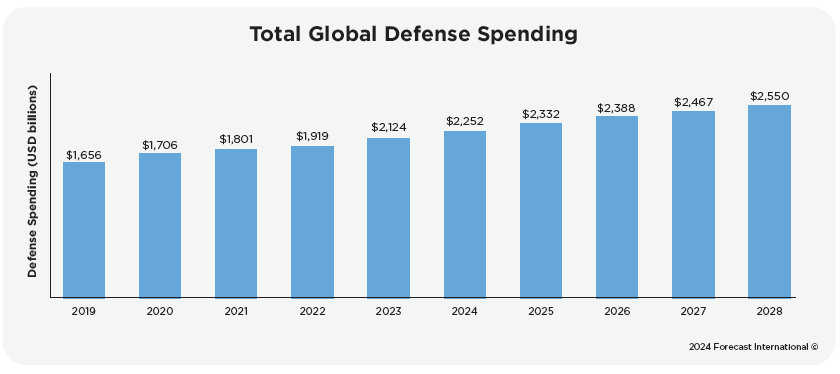

Total global defense spending grew at its fastest pace in the last decade from 2022 to 2023, as governments respond to security crises unfolding around the world. Combined military outlays jumped 10.4 percent in 2023 on strong growth from nearly all of the top spenders, bringing the global total above $2 trillion for the first time.

The Russian invasion of Ukraine, begun on February 24, 2022, continues to serve as a major impetus for European defense spending growth, as countries on the continent embark on multiyear modernization projects. The security environment in the Middle East, meanwhile, was thrown into turmoil after Hamas launched attacks on Israel on October 7, 2023, resulting in a major Israeli offensive into the Gaza Strip. In wake of the October attacks, Iranian-backed militias around the region have fired missiles and drones at military installations and commercial shipping, stoking concern of wider conflagration.

Ascendant defense spending in 2023 contrasted the slowing outlook for the global economy. Economic growth boomed in 2021 as economies reopened after the COVID-19 pandemic, but high inflation and tightening credit conditions slowed global GDP growth into 2022 and 2023. Oil prices have lost their “war premium” – the spike in barrel price after Russia’s invasion – but settled in between $70-90 per barrel.

But as the world begins to experience a bifurcation in trade, diplomacy, energy, and security unseen since the latter stages of the Cold War, a new dawn in security approach and military spending is emerging across Australia, the European continent, Japan, Southeast Asia, and Taiwan. The result will be a period of intense defense investment and procurement into the mid-2020s – and possibly out to 2030. Countries ranging from Canada to the Netherlands to Poland are looking to recapitalize and improve their capabilities, while Sweden, Finland and the Baltics are revisiting, refining, and improving their whole-of-government security approaches.

Defense expenditure is being channeled into procurement focusing on fighting and winning a conventional war against a peer foe, in contrast to the counterinsurgency focus of the last few decades. This is entailing orders for artillery systems and ammunition, main battle tanks, armored vehicles, air-defense missiles, and drones. Furthermore, global militaries are investing in upgrading their platforms to improve survivability on the modern battlefield, particularly as prospective enemy arsenals become stocked with cruise missiles, loitering munition drones, and electronic warfare systems able to disrupt formations and communications.

Get your FREE copy of part one of this whitepaper series by clicking the image below.

For more than 50 years, Forecast International intelligence reports have been the aerospace and defense industry standard for accurate research, analysis, and projections. Our experienced analysts compile, evaluate, and present accurate data for decision makers. FI's market research reports offer concise analysis of individual programs and identify market opportunities. Each report includes a program overview, detailed statistics, recent developments and a competitive analysis, culminating in production forecasts spanning 10 or 15 years. Let our market intelligence reports be a key part of reducing uncertainties and mastering your specific market and its growth potential. Find out more at www.forecastinternational.com

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International

- Forecast International