With the 2024 Farnborough International Airshow approaching next week, global aerospace and defense firms are gearing up to present their innovations on the world stage. One such effort, sure to garner attention during the U.K.-hosted show, is NATO’s Next Generation Rotorcraft Capability (NGRC) program.

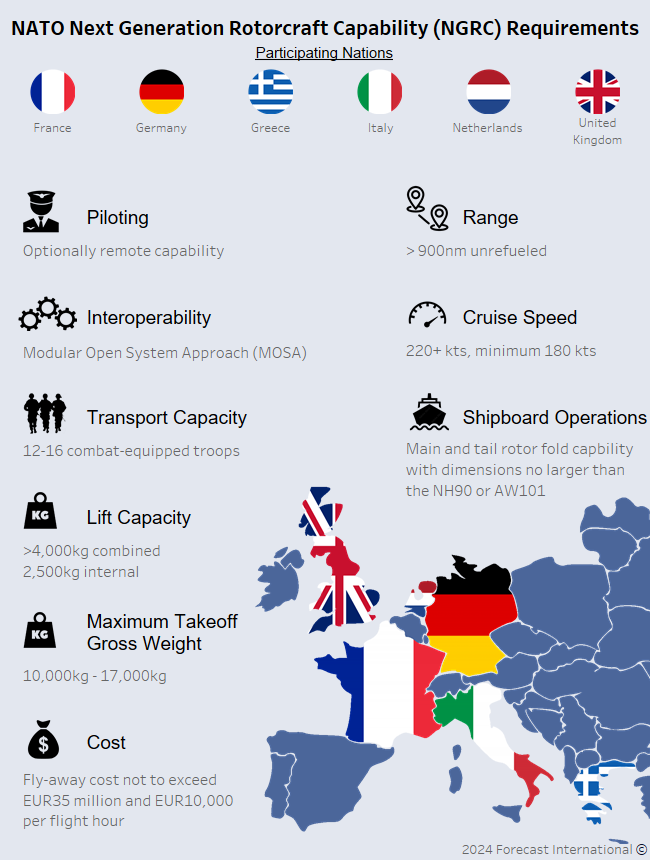

The NGRC project, aimed at fielding an advanced medium-lift rotorcraft between 2035-2040 for NATO fleets, could achieve its next milestone concurrent with the European airshow as the announcement of concept study contracts for up to three manufacturers is likely imminent. Farnborough represents a fitting venue for NGRC discourse as the U.K. is a core partner with France, Germany, Greece, Italy, and the Netherlands.

In 2021, the NGRC contracting authority, the NATO Support and Procurement Agency (NSPA), published a list of required and desired attributes for the NGRC rotorcraft. Though the list of system needs could change following the concept stage, the objectives provide a starting point for evaluating potential designs and understanding how existing rotorcraft capabilities measure up.

The NGRC aircraft must also afford rapid mission reconfiguration to support a range of flight operations including Anti-Surface Warfare (ASuW), Anti-Submarine Warfare (ASW), Electronic Warfare (EW), Search and Rescue (SAR), Personnel Recovery (PR), and Medical Evacuation (MEDEVAC). Desired attributes include a hybrid power plant, integration with uncrewed systems, internal C-17 air transport capability, aerial refueling capability, and provisions for crew-served weapons and air-launched effects (ALE) armaments.

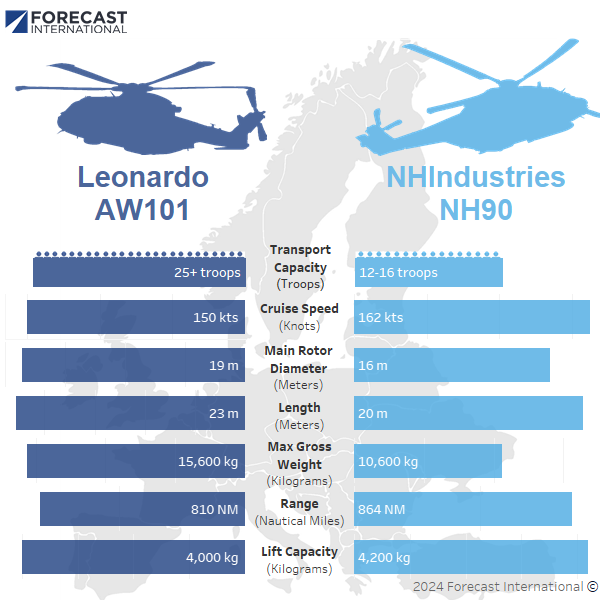

NGRC will replace nearly 1,000 European rotorcraft, predominantly NH90 and AW101 helicopters. A comparison of their specifications and performance with the requirements for NGRC highlights several key points.

Firstly, speed is undoubtedly the primary differentiating factor. Due to the aerodynamic limitations of conventional helicopters, achieving speeds exceeding 220 knots will require advanced rotorcraft designs such as tiltrotor or pusher prop aircraft, evident in the likely contender’s proposals.

Secondly, the optional remote operating capability marks a significant technological leap from traditional crewed helicopters.

Lastly, manufacturers must adhere to the size constraints and performance characteristics of a medium-lift helicopter in maritime settings, posing potential challenges in size and cost.

Potential Suitors

NATO has not officially disclosed the prime aircraft builders vying for the bid. However, three major players are anticipated: Airbus, Lockheed Martin’s Sikorsky, and a collaborative effort between Bell and Leonardo. It remains uncertain how current models or prototypes will inform or align with new designs for the NGRC initiative. Nonetheless, expectations center on three competitors to deliver a solution for NATO’s military rotorcraft needs.

Airbus

Airbus Helicopters CEO Bruno Even revealed in May that the Airbus Racer will form the foundation of the company’s NGRC proposal. This demonstrator helicopter features a traditional main rotor supplemented by twin six-bladed pusher propellers and retractable landing gear. The Racer completed its first flight in April, achieving a speed of 165 knots during a second flight in May. Airbus officials aim to reach 220 knots in upcoming test flights while demonstrating improved fuel efficiency compared to traditional helicopters.

Bell-Leonardo

Bell and Leonardo agreed to leverage their tiltrotor technologies for their NGRC proposal, signing a collaboration agreement in February. They will likely present a mature design based on Bell’s V-280 Valor and Leonardo’s AW609 tiltrotors.

The V-280 Valor, capable of speeds over 280 knots, already meets many of the NGRC requirements and is scheduled for fielding with the U.S. Army by FY31. The AW609, a civilian tiltrotor, has a cruise speed of 270 knots and continues to make headway toward critical certification milestones. In what was likely a direct signal to NGRC officials, an AW609 completed successful shipboard landing trials on an Italian aircraft carrier in April.

Lockheed Martin subsidiary Sikorsky plans to submit an NGRC concept based on its X2 coaxial design technology and has already contributed to the program. In December 2023, Lockheed Martin received its third related contract to study open system architecture (OSA) for the NGRC.

Sikorsky

Sikorsky is eager to win a buyer for its high-speed coaxial rotor X2 technology after its Defiant X and Raider X prototypes failed to secure long-term U.S. Army procurement contracts with the Future Long Range Assault Aircraft (FLRAA) and defunct Future Attack Reconnaissance Aircraft (FARA) programs. Yet, Sikorsky’s work on future vertical lift initiatives proves the technology can meet the high-speed requirements for NGRC. Their experience scaling the X2 technology for different payloads and dimensions positions Sikorsky well to achieve NRC objectives.

Determinative Factors

Shipboard operations and cost pose significant challenges for the bidders. The Bell-Boeing V-22 Osprey tiltrotor is the sole aircraft with a proven track record at sea among advanced rotorcraft technologies. Bell has previously presented a marinized V-280 concept, but adapting advanced rotorcraft for folding, stowing, and naval flight operations remains a critical task for interested builders.

Procurement cost may ultimately dictate design selection if NATO maintains its price requirement. The AW101 and NH90 align closely with the NGRC cost cap goal of EUR35 million per unit. Manufacturers must offer competitive bids that balance advanced rotorcraft technologies with cost-savings measures, noting the V-280’s 2018 price tag of $43 million.

Protecting and strengthening the European industrial base could very well determine the competition. With six NATO countries fully engaged and three others contributing (Canada, Spain, and the U.S.), the NGRC effort presents a sweeping aerospace initiative. NATO officials will surely look to prioritize the future of European aircraft development, manufacturing, and technology investments.

With Bell and Leonardo now joined on NGRC, the forthcoming selection of the three prime manufacturers for design studies by 2025 will likely come as no surprise. But, with what appears to be three contrasting potential plans for NGRC, the debate over next-generation rotorcraft design will continue. NATO’s eventual selection will add one more vote to the long-standing question of the conventional helicopter’s successor.

A former naval officer and helicopter pilot, Jon covers a range of Forecast International reports and products, drawing on his 10-year background in military aviation, operations, and education. His previous military assignments include multiple overseas deployments supporting operations in the Arabian Gulf, NATO exercises, and humanitarian missions. Jon’s work is also influenced by his time as a former Presidential Management Fellow and international trade specialist at the Department of Commerce.

Before joining Forecast International, Jon also served as an NROTC instructor and Adjunct Assistant Professor at the University of Texas, where he taught undergraduate courses on naval history, navigation, defense organization, and naval operations and warfare. A lifelong reader and learner, his academic and professional interests include aviation, political and military history, national defense and security, and foreign area studies.