After a challenging FY23, ThyssenKrupp has laid the groundwork for a transformed company in the year ahead.

For the company’s 2023 fiscal year ended September 30, 2023, ThyssenKrupp’s sales fell almost 9 percent to EUR37.5 billion compared to EUR41.1 billion in FY22. Net loss for the year was EUR2.0 billion compared to net income of EUR1.2 billion in the year ago period. The 2023 loss was primarily attributed to impairment losses of EUR2.1 billion at the Steel Europe unit.

For the past several years the company has been working through its various restructuring efforts. The latest of these was announced in September 2023 and will see the company reorganized around five units, Automotive Technology, Decarbon Technologies, and Materials Services segments. Steel Europe and Marine Systems will remain part of the group for the time being with the ultimate plan to spin off these operations into independent entities.

Once these efforts reach fruition, ThyssenKrupp will be focusing much of its efforts on green technologies not only through its new Decarbon unit but also throughout its remaining operations.

Through its Material Services segment, the company supplies raw materials and components to the aviation industry through ThyssenKrupp Aerospace. The unit stocks a range of materials required in aircraft manufacturing such as aluminum, titanium, steel, special alloys and aerospace plastics. It also offers processing services for the industry, providing cut-to-size, machine-ready material for manufacturers. Finally, the aerospace unit also provides logistics services including warehousing, distribution, and supply chain management.

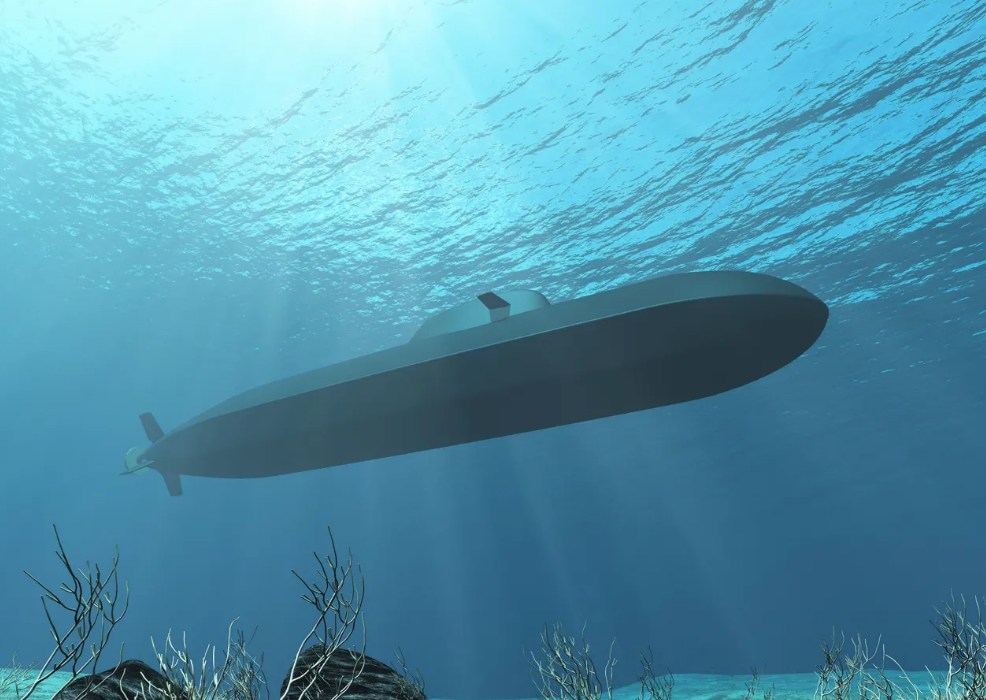

The plan for its defense-facing business, ThyssenKrupp Marine Systems, is to position it as a standalone operation or combine it in an alliance to improve its competitive position. As part of an effort to strengthen its business, TKMS acquired MV Werften’s Wismar shipyard from the insolvent company in mid-2022. The plan is that this yard, which used to produce cruise ships, will take on additional submarine production, possibly as early as 2024.

The firm’s order book for submarines has been growing of late. While no major orders were signed in 2023, intake in previous years has provided the segment with a healthy EUR12.6 billion backlog. Included in this total is a EUR5.5 billion order from Norway and Germany for six submarines, which also included an order from the Italian submarine project. This was followed in 2022, with an EUR3 billion order from Israel for three new design Dakar class submarines.

Despite the recent success of ThyssenKrupp Marine Systems, the unit’s long-term prospects remain uncertain due to the fragmented nature of European warship production. This fragmentation leads to excessive competition among shipyards for a limited number of contracts.

To address this challenge, ThyssenKrupp Marine Systems is pursuing a strategy that encompasses operational strengthening and potential consolidation with domestic rivals. The company has expressed interest in selling a stake in its operations, with potential buyers including Rheinmetall, German Naval Yards (GNYK), Lürssen, and Naval Group, which may occur once it is independent of ThyssenKrupp.

A key factor driving the consolidation push is ThyssenKrupp Marine Systems’ 2020 loss of a €4.5 billion contract for four MKS-180 frigates for the German Navy to Dutch company Damen. Both the company and the German government view a merger with a domestic rival as a desirable outcome, enabling the creation of a national champion to compete against European powerhouses such as Naval Group in France and Fincantieri in Italy. This consolidation would likely find favor with Germany’s strong labor unions.

Previous attempts to establish a cross-border partnership with Naval Group have faltered due to political concerns about shipyard closures and job losses. A potential solution could involve ThyssenKrupp specializing in submarine construction, while Naval Group focuses on surface combatants. However, such a deal would likely face significant labor challenges arising from the consolidation process.

A military history enthusiast, Richard began his career at Forecast International as editor of the World Weapons Weekly newsletter. As the Internet became central to defense research, he helped design the company’s Forecast Intelligence Center and now coordinates the FI Market Recap newsletters for clients. He also manages two blogs: Defense & Security Monitor, which covers defense systems and international security issues, and Flight Plan, focused on commercial aviation and space systems.

For more than 30 years, Richard has authored Defense & Aerospace Companies, Volume I (North America) and Volume II (International), providing detailed data on major aerospace and defense contractors. He also edits the International Contractors service, a database tracking all companies involved in programs covered by the FI library. Richard currently serves as Manager of the Information Services Group (ISG), which develops outbound content for both Forecast International and Military Periscope.