To say the U.S. FY24 budget process has been tumultuous would be an understatement.

In addition to the commonplace continuing resolutions that are needed to avoid shutdowns when Congress is unable to pass a budget on time, we’ve also seen fights over the debt ceiling, supplemental spending requests, and an ousted speaker of the House that have disrupted negotiations over spending.

One half of the budget process is actually complete, as Congress was able to pass the FY24 National Defense Authorization Act in December. Funding details from that legislation can be viewed on Forecast International’s free FY24 U.S. Defense Budget Spotlight, an online dashboard tracking defense committee recommendations throughout the budget process. The defense authorization bill recommended boosting both procurement and research, development, test & evaluation accounts, while reducing funding for personnel and operations & maintenance. However, it’s important to note the funding tables in the authorization bill effectively serve as recommendations from the armed services committees, whereas congressional appropriators ultimately decide how much funding the Pentagon will have available to spend each year.

The appropriations process has been stalled since the new fiscal year started on October 1, and Congress recently passed a third CR that will keep the Pentagon funded at FY23 levels through March 8. The House passed its version of the FY24 defense spending bill in September. The Senate released its spending proposal in July, but the chamber did not vote on the legislation. Since then, congressional leaders have agreed on providing $886 billion for national security programs requested by the administration, which is in line with the spending limits established in the debt ceiling agreement. Although we have a good idea of what the total defense budget will be, House and Senate appropriators must still negotiate a multitude of differences between their respective spending proposals. That process will take place over the coming weeks.

Through an examination of the House and Senate spending proposals released earlier in the budget process, we can offer a preview of some of the key weapons funding decisions that will be discussed during those negotiations. Readers can also view topline comparisons using the FY24 U.S. Defense Budget Spotlight.

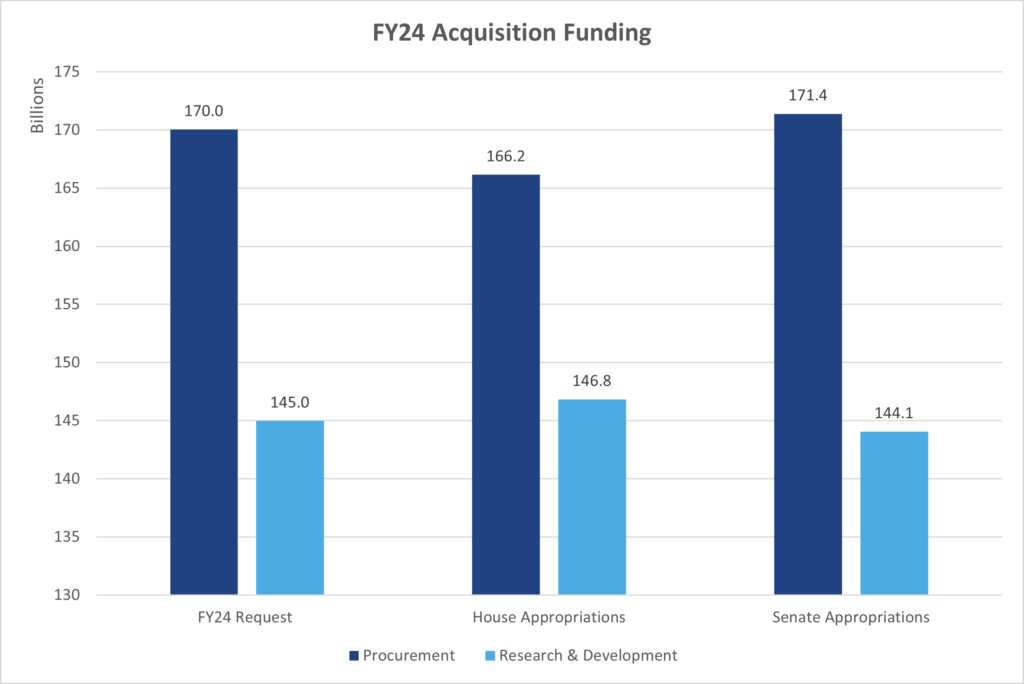

The House and Senate appropriators took somewhat different approaches when they marked up the Pentagon’s acquisition spending plans. The House recommended reducing procurement spending by $3.9 billion and adding $1.9 billion for research and development programs. Conversely, the Senate proposal would add $1.3 billion for procurement while reducing research and development by nearly $1 billion. There is a $5.2 billion delta between the two bills for procurement and a $2.8 billion difference on the research and development side, opening the door for negotiations that will impact dozens of programs over the remainder of the fiscal year.

Navy and Marine Corps Procurement

The House and Senate bills are $3.3 billion apart on the Navy and Marine Corps procurement budget, which is the largest gap of any of the services. The House recommended cutting $2 billion, while the Senate added $1.2 billion. Compared to the House bill, the Senate proposal would provide 8.0 percent ($1.4 billion) more for aircraft, 5.1 percent ($297.2 million) more for weapons, 5.5 percent ($208.7 million) more for Marine Corps procurement, and 7.8 percent ($1.1 billion) more for electronics and miscellaneous programs. It should be noted that both chambers cut funding for Navy weapons, but the House cut is steeper.

In terms of individual programs, the House recommended adding five CMV-22s and one CH-53K, while the Senate opted to add ten P-8A maritime patrol aircraft. Both chambers recommended funding reductions for the MQ-25 unmanned tanker. The House and Senate also both cut funding for the Navy’s Conventional Prompt Strike hypersonic weapon, but the Senate’s $341.3 million reduction is larger than the House’s $85.4 million cut. However, the House recommended a larger cut for the Long-Range Anti-Ship Missile (LRASM). The House also recommended a $60.9 million reduction for the Marine Corps’ NMESIS program – a Naval Strike Missile mounted on a Joint Light Tactical Vehicle – due to contract award delays, and another $39.2 million for the Naval Strike Missile itself. Both of those items are fully funded in the Senate bill. The House also suggested an overall cut for the Ground Based Air Defense program, but both chambers added $4.5 million for the medium range intercept capability that falls under the GBAD umbrella.

The House and Senate also took a different approach to Navy shipbuilding programs. The Senate recommended adding $1.4 billion in advance procurement funding to support an additional DDG 51 class destroyer in FY25 and another $500 million to support procurement of the LPD Flight II amphibious warship, LPD 33. Those plus-ups would be largely offset by zeroing out the Navy’s $1.7 billion request for a new submarine tender. The House markup did not include those adjustments, but it added $400 million for four Ship-to-Shore Connectors that were not included in the Senate bill.

Air Force Procurement

There is a $2.2 billion delta for Air Force procurement programs between the House and Senate, but the service loses out overall in both markups. The House would reduce the service’s procurement budget by $2.5 billion in FY24, compared to a more modest $314.5 million reduction proposed by the Senate. The most notable difference is the service’s missile account, which falls by $1.1 billion in the House spending plan compared to the administration’s request. The Senate would add a net $253.2 million for missile procurement for the Air Force.

The missile cuts in the House legislation stem from $1.9 billion worth of funding removed for bulk missile buys across the services. Referred to as “economic order quantity” buys, this funding was intended to reduce unit costs when buying a higher volume of equipment. The request for EOQ funding was aimed at replenishing weapons donated to Ukraine. For the Air Force, the chamber recommended cutting $769.7 million the Joint Air-to-Surface Standoff Missile (JASSM), $212.4 million for the Advanced Medium-Range Air-to-Air Missile (AMRAAM), and $99.8 million for the Long-Range Anti-Ship Missile (LRASM). Meanwhile, the Senate added $200 million for the ground based strategic deterrent and $100 million for missile spare parts. The Senate also drafted a supplemental funding package that included $193 million for homeland missile defense equipment.

Army Procurement

There is less of a divergence when it comes to the Army’s topline procurement budget, where the two chambers only differ by $331.3 million. However, there are still multiple discrepancies to work out in a conference agreement. Both chambers recommended cuts for Army missile programs, but the House would implement a larger overall reduction due to funding adjustments for Patriot, Precision Strike Missile, Joint Air-to-Ground Missile, Long-Range Hypersonic Weapon, and Guided Multiple-Launch Rocket System (GMLRS). On the other hand, the Senate recommended a $53 million cut for the Indirect fire Protection Capability Increment 2-I effort, which was fully funded by the House. Both the House and Senate markups added funding for vehicles, but the beneficiaries differed between the two bills. The House supported increased investment in Stryker upgrades, Paladin howitzers, and Humvees that were not reflected in the Senate markup. The Senate bill bolstered funding for Abrams upgrades and heavy tactical vehicles. Both chambers recommended some cuts to the Joint Light Tactical Vehicle program.

The House added $120 million for UH-60 helicopters that were not included in the Senate bill, but appropriators traditionally support UH-60 plus-ups in their conference agreements. The House also added $68 million for MQ-1C Gray Eagle modifications. On the other hand, the Senate wants to add four CH-47 helicopters that did not appear in the House bill. Negotiators will also discuss a Senate recommendation to zero out funding for the Future Unmanned Aircraft System (FUAS) and a House proposal to cut $182.1 million for Apache upgrades.

Research and Development

As with procurement, the Navy represents the largest delta between the House and Senate research and development markups. The House recommended adding $768.6 million for Navy RDT&E, compared to a $386.4 million cut by the Senate, reflecting a difference of $1.2 billion, or 4.2 percent. In general, the Senate prioritized basic research and applied research initiatives, while the House provided more support for programs further along in the development cycle, including operational systems development for various aircraft. Programs like the Next Generation Jammer Increment II and SM-6 saw cuts in both chambers, but the House reductions were more modest. The Senate also pushed for cuts for RQ-4 modernization, a rapid prototyping and experimentation fund, and several classified programs. It wasn’t all bad news in the Senate markup, however. Compared to the House, the Senate provided more funding for precision strike weapons development, including the Sea-Launched Nuclear Cruise Missile (SLCM-N) the Navy wanted to cancel, as well as the DDG 1000 destroyer and the Conventional Prompt Strike program. Notably, the FY24 defense authorization bill also supported keeping the SLCM-N alive.

There is an $856.1 million delta between the House and Senate proposals for Army research programs, reflecting increases of $983.1 million and $188 million by the two chambers, respectively. As with the Navy, the Senate recommends more funding than the House for basic research and applied research, including extra funding for university research initiatives. However, the Senate offsets those increases by cutting $399 million for the Lower Tier Air and Missile Defense Sensor (LTAMDS) and $410.2 million for the XM30 infantry fighting vehicle. The House fully funded both of those programs and also recommended more funding for combat vehicle improvement programs and Future Vertical Lift than the Senate.

Both chambers recommended cutting overall funding for Air Force research programs, with the House proposing a $445.7 million cut, and the Senate recommending a larger reduction of $1.2 billion. The topline comparison is somewhat skewed because of a $600 million difference in funding in favor of the House for a classified slush fund that includes pass-through money for agencies outside of the Air Force. The slush fund makes it difficult to determine what programs are impacted by the classified adjustments. If you remove that slush fund from the equation, then both chambers provide similar topline adjustments.

The Modular Advanced Missile, Stand in Attack Weapon, and Survivable Airborne Operations Center faced cuts in both markups, but the Senate cuts were larger. The Senate also went on to reduce funding for the Rapid Defense Experimentation Reserve, defensive cyberspace operations, and the Hypersonic Attack Cruise Missile, all of which were fully funded in the House bill. However, the Senate recommended a bigger increase for advanced engine development, which would benefit the Air Force’s Next Generation Air Dominance platform. The House zeroed out development funding for hypersonics prototyping, reflecting termination of the Air-Launched Rapid Response Weapon. The Senate only cut around half of the funding from that line item.

All the items discussed in this piece represent only some of the dozens of individual program adjustments made by the House and Senate throughout the FY24 budget markup process. Forecast International’s U.S. Defense Budget Forecast database provides detailed comparisons of congressional budget markups for every line item in the Pentagon’s procurement and RDT&E accounts.

The Clock is Ticking

For now, the Pentagon must wait for lawmakers to iron out the differences between the House and Senate versions of the FY24 defense appropriations bill. The latest continuing resolution extends the funding deadline to early March, which is nearly halfway through the fiscal year. Pentagon officials have warned lawmakers about the negative impact a full-year CR would have on the military, putting increased pressure on Congress to finalize the FY24 defense appropriations bill. Lawmakers must also determine the way forward for the administration’s $106 billion supplemental spending request that includes aid for Ukraine and Israel, funding in support of Taiwan and the Indo-Pacific theater, and domestic border security. The repeated delays will also impact the administration’s ability to finalize its pending FY25 budget request, which would normally be released in early February. The FY25 request will have to wait as the clock keeps ticking on the FY24 budget process.

More Defense Budget Data

Forecast International’s U.S. Defense Budget Forecast makes it easy to navigate the latest U.S. defense budget. The product features sorting and data visualization options and presents the entire Future Years Defense Program (FYDP) through an online interface with downloadable spreadsheets. This is the go-to service for anyone looking to save time and energy in navigating the massive Department of Defense budget.

Shaun's deep-rooted interest in military equipment continues in his role as a senior defense analyst with a focus on the United States. He played an integral role in the development of Forecast International's U.S. Defense Budget Forecast, an interactive online product that tracks Pentagon acquisition programs throughout the congressional budget process. As editor of International Military Markets – North America, Shaun has cultivated a deep understanding of the vast defense markets in the United States and Canada. He is a regular contributor to Forecast International's Defense & Security Monitor blog and has co-authored white papers on global defense spending and various military programs.